Loading

Get Sales And Use Tax License Application.doc. Sales And Use Tax License Application

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Sales And Use Tax License Application online

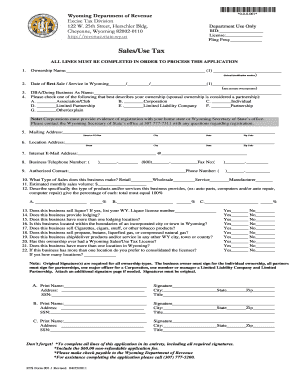

Filling out the Sales And Use Tax License Application is an essential process for businesses operating in Wyoming. This guide provides clear and detailed instructions on how to complete the application accurately to ensure smooth processing.

Follow the steps to successfully complete your application.

- Locate the ‘Get Form’ button to obtain the form and open it in your chosen editor.

- In the first section, enter the ownership name along with the federal identification number. Make sure this information is accurate.

- Provide the date of your first sale or service in Wyoming and indicate the state and date of incorporation if applicable.

- Fill in the Doing Business As (DBA) name, if applicable, and check the appropriate ownership type that best describes your business (such as Corporation, Partnership, etc.).

- Complete the mailing address and location address fields, ensuring that all components including street, city, state, and zip code are filled correctly.

- Enter your internet email address and business telephone number, making sure to include the area code.

- List an authorized contact person for the business along with their phone number.

- Specify the types of sales your business engages in, such as retail, wholesale, or service, and provide an estimated monthly sales volume.

- Describe the specific products or services your business provides, along with their percentage contribution to the total, ensuring that the total equals 100%.

- Answer questions regarding specific business activities such as selling liquor, providing lodging, or other services.

- Indicate if your business has previously had a Wyoming Sales/Use Tax License and whether it has more than one location.

- If applicable, indicate if you wish to consolidate licenses for multiple locations.

- Gather original signatures as required for your ownership type, and print names and addresses as needed.

- Don’t forget to include the $60.00 non-refundable application fee and complete all lines of the application.

- After reviewing the application for completeness, save your changes, and choose whether to download, print, or share the form as needed.

Complete your Sales And Use Tax License Application online today to ensure your business is compliant.

(1) A seller in Texas may accept a resale certificate in lieu of tax from a retailer located outside Texas who purchases taxable items for resale in the United States or Mexico in a transaction that is a sale for resale, as defined in subsection (b) of this section.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.