Loading

Get Aircraft Sales And Use Tax Return (rev-832). Forms/publications

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Aircraft Sales And Use Tax Return (REV-832) online

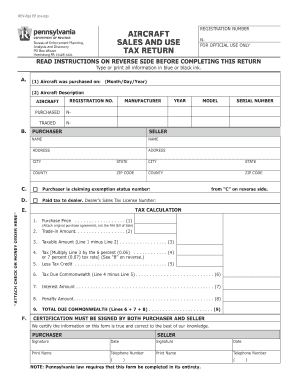

Filling out the Aircraft Sales And Use Tax Return (REV-832) is essential for individuals or entities involved in the purchase of aircraft in Pennsylvania. This guide provides a detailed walkthrough of the form, ensuring that users can navigate each section with confidence and accuracy.

Follow the steps to successfully complete your tax return

- Press the ‘Get Form’ button to access the Aircraft Sales And Use Tax Return (REV-832). Open the form in your preferred editor.

- In section A, input the purchase date of the aircraft in the format required (Month/Day/Year), and provide a detailed description of the aircraft, including its registration number, make, model, and serial number.

- Complete section B by entering the full name and address of both the purchaser and the seller. Make sure to note the tax rate applicable if the purchaser resides in Philadelphia or Allegheny County.

- In section C, indicate any exemption status by checking the appropriate box and entering the corresponding exemption number. Ensure that all fields are filled out completely.

- In section D, if tax has been paid to a dealer, check the box to confirm this and enter the dealer’s sales tax license number. Attach any necessary proof of payment.

- Proceed to section E for tax calculation. Enter the purchase price on Line 1 and the trade-in amount on Line 2. Subtract Line 2 from Line 1 to find the taxable amount on Line 3.

- Calculate the sales tax due on Line 4 by multiplying the taxable amount from Line 3 by the applicable tax rate (either 0.06 or 0.07).

- Enter any tax credit on Line 5 for taxes already paid to another state. Subtract Line 5 from Line 4 to determine the net sales tax due on Line 6.

- If applicable, calculate interest amounts on Line 7 and penalties on Line 8. Sum Lines 6, 7, and 8 on Line 9 to find the total amount due.

- Ensure both the purchaser and seller sign and date the form in the certification section. Attach the original purchase agreement to your submission.

- Finalize the process by saving your completed form. You may also download, print, or share the document as required before mailing it, along with payment, to the provided address.

Begin filling out the Aircraft Sales And Use Tax Return online today to ensure a smooth and timely submission.

The retail sale of an aircraft, including all accessories attached when delivered to the purchaser, is subject to the 4.75% general State rate of sales and use tax with a maximum tax of $2,500 per article. The retail sale of a qualified jet engine as defined in N.C. Gen.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.