Loading

Get Form Inirp-b Indiana Department Of Revenue State Form 4949 ...

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Form INIRP-B Indiana Department Of Revenue State Form 4949 online

This guide provides a step-by-step approach to completing the Form INIRP-B, required by the Indiana Department of Revenue. Designed for users with varying levels of experience, this guide helps you navigate each section of the form confidently.

Follow the steps to successfully complete your form online.

- Click ‘Get Form’ button to access the form and open it in the designated editor.

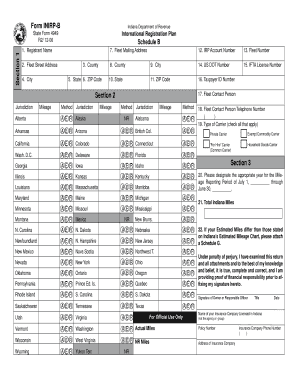

- In Section 1, start by entering the Registrant Name as registered with the Indiana Secretary of State or the Indiana Department of Revenue. Ensure accuracy to prevent issues with your application.

- Enter the Fleet Street Address if it differs from the Indiana Business Street Address on Schedule A. Use lines 2 through 6 for this information.

- If your Fleet Mailing Address is different from the Applicant Mailing Address on Schedule A, provide it in lines 7 through 11.

- For line 12, input your Indiana IRP Account Number. Then, enter the Fleet Number in line 13.

- In line 14, provide the US DOT Number associated with the Registrant. This number is crucial for compliance with federal regulations.

- Fill out line 15 with the International Fuel Tax License Number, ensuring proof of IFTA responsibility is maintained.

- Enter your Taxpayer Identification Number in line 16, which is mandatory for all business entities.

- For line 17, indicate the name of the Fleet Contact Person. If this individual is not a registered Responsible Officer, a Power of Attorney may be required.

- Complete line 18 with the telephone number of the Fleet Contact Person.

- In line 19, select all applicable types of carriers from the provided options to classify your fleet accurately.

- Proceed to Section 2 and enter the Total Mileage for each IRP jurisdiction you traveled. Follow the instructions to indicate the mileage method: Actual, Estimated, or Reported.

- Move to Section 3. Specify the appropriate year for the Mileage Reporting Period on line 20, and submit the Total Indiana Miles on line 21.

- If there are discrepancies in your estimated miles compared to Indiana’s chart, attach a Schedule G as instructed on line 22.

- Finally, ensure you sign the form in ink, include your job title and date, and provide the information regarding your insurance company.

Complete your documents online today for a smoother filing process.

DOR frequently sends letters to customers to request needed information to process a tax return. Not responding to an information request can cause a tax return to remain unprocessed, generating an overdue payment with penalties and interest owed.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.