Loading

Get Forms & Instructions - Sales North Dakota Office Of State Tax...

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Forms & Instructions - Sales North Dakota Office Of State Tax online

Filling out the Forms & Instructions - Sales North Dakota Office Of State Tax online can be straightforward with the right guidance. This comprehensive guide will walk you through each step of the process, ensuring you complete the form accurately and efficiently.

Follow the steps to complete the sales tax exemption certificate online.

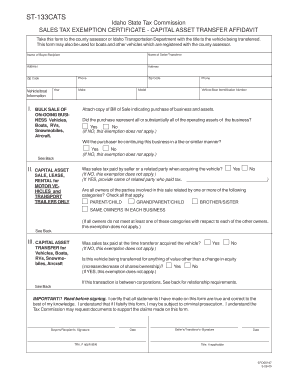

- Click the ‘Get Form’ button to access the sales tax exemption certificate online and open it in your preferred editor.

- Begin by entering the name of the buyer/recipient in the designated field, followed by their address and phone number. Ensure all contact information is accurate for future correspondence.

- Next, fill in the seller/transferor's details, including their name, address, and phone number.

- Provide vehicle or boat information such as the year, make, model, and vehicle identification number in the specified fields.

- For the bulk sale of an ongoing business, indicate whether all or substantially all of the operating assets are being purchased, and confirm if the purchaser will continue the business in a similar manner.

- If applicable, complete the section pertaining to capital asset sale, lease, or rental for motor vehicles and transport trailers. Answer whether sales tax was paid by the seller or a related party.

- Address the section concerning capital asset transfers. State whether sales tax was paid at the time of acquisition and whether the transfer involves anything of value beyond a change in equity.

- Review all entered information for accuracy and completeness. Sign the form where indicated, providing the date and title if applicable for both the buyer and seller.

- Once all sections are complete and verified, you can save the changes, download, print, or share the form as needed.

Begin completing your forms online today to ensure timely processing.

In North Dakota, sales tax is levied on the sale of tangible goods and some services. The tax is collected by the seller and remitted to state tax authorities.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.