Loading

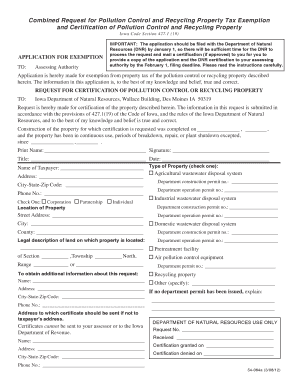

Get 54064.pmd. Form St - Sales, Use, And Gross Receipts Tax

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the 54064.pmd. Form ST - Sales, Use, And Gross Receipts Tax online

This guide provides clear, user-friendly instructions on how to complete the 54064.pmd. Form ST for sales, use, and gross receipts tax online. Users can follow the step-by-step guidance to ensure accurate submission and compliance with tax regulations.

Follow the steps to successfully complete the form online.

- Press the ‘Get Form’ button to access the 54064.pmd. Form ST and open it in your preferred document editor.

- Fill in your personal or business information, including name, address, and contact details, ensuring accuracy for future correspondence.

- Indicate your jurisdiction and the specific tax period for which you are filing. This helps determine the correct rate and assesses your tax obligations.

- Complete the section related to gross receipts, where you will detail your business's total sales, excluding any exempt items.

- Provide information on any exempt sales and applicable deductions, ensuring you maintain all relevant documentation to support your claims.

- Review all sections for completeness and accuracy. This step helps prevent delays or complications in processing your submission.

- Once the form is complete, save your changes, and choose to download, print, or share the form as needed.

Get started by filling out the 54064.pmd. Form ST online now to ensure timely compliance with tax regulations.

Use tax is a complementary or compensating tax to the sales tax and does not apply if the sales tax was charged. Use tax applies to purchases made outside the taxing jurisdiction but used within the state. Use tax also applies to items purchased exempt from tax which are subsequently used in a taxable manner.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.