Loading

Get Arizona Form 285b

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Arizona Form 285b online

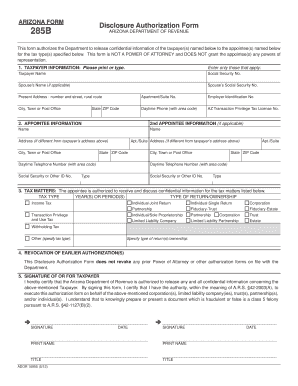

This guide provides a clear and supportive approach to completing the Arizona Form 285b online. This form is essential for authorizing the Department of Revenue to release confidential taxpayer information to designated appointees.

Follow the steps to complete the Arizona Form 285b online

- Click ‘Get Form’ button to obtain the Arizona Form 285b and open it in your preferred editor.

- Begin by providing the taxpayer information. Fill in the taxpayer's name and Social Security number, along with the spouse's name and Social Security number if applicable. Ensure to include the present address, apartment or suite number, employer identification number, city or town, daytime phone number, Arizona transaction privilege tax license number, and zip code.

- Input the appointee information next. Complete the name, address, city or town, and state zip code of the primary appointee. If there is a second appointee, repeat these details accordingly.

- Specify the tax matters by selecting the type(s) of tax the appointee is authorized to discuss. Provide the appropriate year(s) or period(s) relevant to each tax type and indicate the type of return or ownership structure.

- In the section for revocation of earlier authorization(s), be aware that this form does not revoke any previous Power of Attorney as per the Department's regulations.

- Finally, sign and date the form in the designated sections. Include your printed name and title to complete the authorization process.

- After filling out the form, you can save your changes, download a copy, print it, or share it as needed.

Take the next step and complete your documents online today.

Additionally, Form 4506-T-EZ, Short Form Request for Individual Tax Return Transcript, can be used to request just a tax return transcript. The tax return and account transcripts are also available by mail, by calling 800-908-9946 and following the prompts.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.