Loading

Get Claim For Local Tax Rebate Form Et-179a - Formupack

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the CLAIM FOR LOCAL TAX REBATE FORM ET-179A - Formupack online

Filling out the Claim for Local Tax Rebate Form ET-179A online can streamline the process of reclaiming local taxes paid on eligible business purchases. This guide provides a step-by-step approach to help users accurately complete the form to facilitate their rebate claims.

Follow the steps to accurately fill out the form online.

- Click 'Get Form' button to access the Claim for Local Tax Rebate Form ET-179A and open it in the digital editor.

- Enter the company name in block 1, providing the full legal name of the business requesting the rebate.

- Input the Federal Employer Identification Number (FEIN) in block 2 to verify your business identification.

- In block 3, enter the mailing address for the business, ensuring it is accurate and up to date.

- Complete blocks 4 to 6 with your city, state, and zip code to finalize the company's location details.

- If you do not possess an Arkansas Sales Tax Permit, fill out blocks 7 to 15 with the owner's name, NAICS code, type of ownership, location address, and contact information.

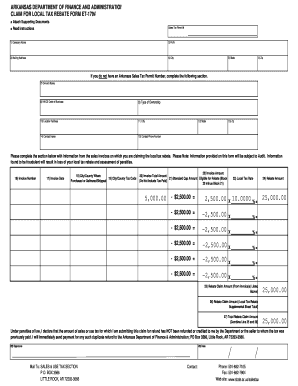

- For block 16, record the invoice number associated with the local tax rebate claim.

- Input the invoice date in block 17, ensuring it reflects the date on the original invoice.

- Indicate the city and county where the purchase occurred or where the product was delivered in block 18.

- Fill in the City/County Tax Code in block 19 to clarify the relevant tax jurisdiction.

- Enter the total amount billed on the invoice in block 20, excluding taxes paid.

- In block 21, provide the standard cap amount eligible for rebate, typically set at $2,500.00 per invoice.

- Calculate the amount after applying the cap by subtracting block 21 from block 20 and enter this in block 22.

- Document the local tax rate applicable to the invoice in block 23.

- In block 24, calculate the rebate amount by multiplying the figure in block 22 by the local tax rate in block 23.

- Consolidate all rebate amounts from previous invoices and enter the total in block 25.

- If applicable, refer to the supplemental sheet to report any additional rebate claims in block 26.

- Add the amounts from blocks 25 and 26 to get the total rebate claim amount and enter this in block 27.

- Sign and date the form in blocks 28 and 29 to validate the claim.

- Prepare to submit your form by ensuring all photocopies of invoices are attached as required.

- Complete your filing by reviewing all entries and confidently save changes, download, print, or share the form as necessary.

Start filling out the Claim for Local Tax Rebate Form ET-179A online to claim your eligible rebate today!

Arkansas Requirements To obtain exemption from Arkansas income tax: o Submit a copy of: ▪ 1) the IRS Determination Letter, ▪ 2) pages 1 and 2 of the IRS Form 1023, and ▪ 3) a statement declaring Arkansas Code Exemption: • The statement must declare that the organization is exempt under ARK. CODE ANN. § 26-51-303.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.