Loading

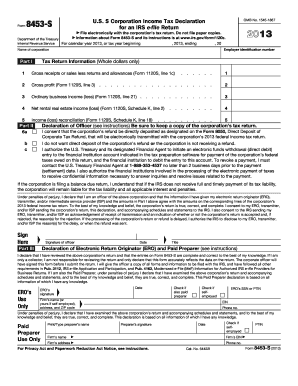

Get 2013 Form 8453-s. U.s. S Corporation Income Tax Declaration For An Irs E-file Return

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the 2013 Form 8453-S. U.S. S Corporation Income Tax Declaration For An IRS E-file Return online

Filling out the 2013 Form 8453-S is a crucial step for S corporations filing their income tax electronically. This guide provides a detailed walkthrough to ensure users can complete the form accurately and confidently.

Follow the steps to fill out your Form 8453-S online:

- Click ‘Get Form’ button to obtain the form and open it in the editor.

- Enter the calendar year or tax year information in the provided field, specifying both the beginning and ending dates.

- Input the Employer Identification Number (EIN) of the corporation accurately in the designated space.

- Provide the name of the corporation as it should appear on the electronic tax return.

- In Part I, fill in the required financial information from your corporation’s Form 1120S, such as gross receipts or sales, gross profit, ordinary business income or loss, net rental real estate income or loss, and income reconciliation. All figures should be in whole dollars.

- Move on to Part II, Declaration of Officer. Indicate the choice regarding direct deposit of the corporation’s refund and electronic funds withdrawal, ensuring any applicable boxes are checked.

- The authorized corporate officer must complete the declaration at the bottom of Part II by signing and dating the form.

- If applicable, in Part III, the Electronic Return Originator (ERO) or paid preparer should fill out their information and sign in the designated areas.

- Once all sections are complete and verified, save the changes, and follow the instructions from your tax preparation software to transmit the completed PDF form along with your electronic return.

Ready to complete your documents? Start filling out your forms online now!

Use this form to: Authenticate an electronic Form 1120S, U.S. Income Tax Return for an S Corporation, Authorize the ERO, if any, to transmit via a third-party transmitter, Authorize the intermediate service provider (ISP) to transmit via a third-party transmitter if you are filing online (not using an ERO), and.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.