Loading

Get Form 668 W

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Form 668 W online

Filling out the Form 668 W online is an important step in managing a levy on wages, salary, and other income. This guide provides clear instructions on how to complete each section to ensure compliance and accuracy.

Follow the steps to complete the Form 668 W online.

- Click ‘Get Form’ button to obtain the form and open it in your preferred editing tool.

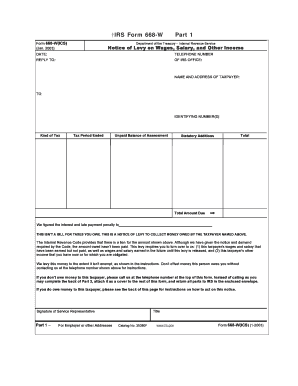

- Complete the 'Notice of Levy' section by entering the required information including the date, telephone number, and IRS office address. Make sure to fill in the name and address of the taxpayer along with their identifying number(s).

- Specify the kind of tax, the tax period ended, and the unpaid balance of the assessment. Additionally, include any statutory additions and the total amount due.

- In the 'Statement of Exemptions and Filing Status' section, indicate the taxpayer's filing status. Check one of the options: Single, Married Filing a Joint Return, Married Filing a Separate Return, Head of Household, or Qualifying Widow(er) with dependent child.

- If applicable, enter the amount for the 'Additional Standard Deduction' if the taxpayer or their spouse is at least 65 years old and/or blind. Specify the people who can be claimed as personal exemptions, along with their relationships and Social Security numbers.

- Check the acknowledgment section to confirm the receipt of the levy and provide necessary information about the levy results.

- Make sure all entries are accurate before saving your changes. You can download, print, or share the completed form as needed.

Start completing your Form 668 W online today to manage your tax obligations effectively.

Part of the taxpayer's wages, salary, or other income is exempt from levy. To claim exemptions, the taxpayer must complete and sign the Statement of Dependents and Filing Status on Parts 3, 4, and 5 and return Parts 3 and 4 to you within 3 work days after you receive this levy.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.