Loading

Get Application For Registration Exemption - South Carolina Secretary ... - Davmembersportal

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Application For Registration Exemption - South Carolina Secretary of State online

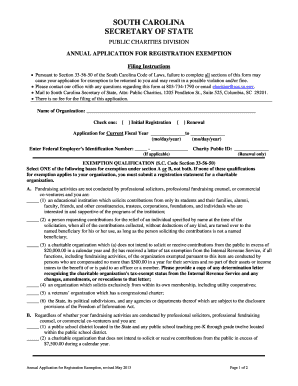

Filling out the Application for Registration Exemption can seem daunting, but it is a straightforward process that allows organizations to apply for exemptions in South Carolina. This guide will walk you through each step, ensuring that you complete the form accurately and efficiently.

Follow the steps to successfully complete your application online.

- Click ‘Get Form’ button to obtain the form and open it in the editor.

- Begin by entering the name of your organization in the designated field. Ensure it accurately reflects your registered name.

- Choose between 'Initial Registration' or 'Renewal' by checking the appropriate box. Specify the application period for the current fiscal year by entering the start and end dates.

- If applicable, enter the Federal Employer’s Identification Number in the specified format. This may be required for tax purposes.

- For renewals, enter the Charity Public ID in the provided field.

- Select one basis for exemption under Section A or B according to your organization's activities. Ensure you read the qualifications carefully before making your selection.

- Provide the legal name of the organization, along with any Doing Business As (DBA) names or former names if relevant.

- Specify your organization’s website if you have one. This is optional but can help provide additional information.

- List a contact person for your organization, including their title, address, and daytime phone number.

- Input the physical address of your organization, including street address, city, state, and zip code.

- Describe the purpose for which your organization was formed in a concise manner.

- Indicate if your organization uses professional solicitors or fundraising counsel. If applicable, ensure to attach a list of these individuals or firms.

- For school districts, provide the list of schools and student organizations that do not maintain separate financial accounts.

- Finally, review all provided information for accuracy. Have both the Chief Financial Officer/Treasurer and the Chief Executive Officer/President print their names, sign, and date the application.

- Once completed, save your changes, download the form, print it for your records, or share it as required.

Complete your Application for Registration Exemption online today to ensure compliance and facilitate your organization's charitable activities.

The income tax withholding for the State of South Carolina includes the following changes: The maximum standard deduction in the case of any exemptions has changed from $3,820 to $4,200. The exemption allowance has changed from $2,590 to $2,670. The table for State income tax withholding calculation has changed.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.