Get Streamlined Sales Tax Certificate Of Exemption

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Streamlined Sales Tax Certificate of Exemption online

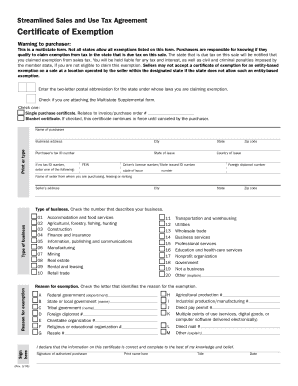

The Streamlined Sales Tax Certificate of Exemption is a crucial document for users looking to claim exemption from sales tax in various states. This guide provides a clear and supportive walkthrough to assist users in correctly filling out the form online.

Follow the steps to complete the Streamlined Sales Tax Certificate of Exemption.

- Click ‘Get Form’ button to obtain the form and open it in the editor.

- Begin by entering the two-letter postal abbreviation for the state where you are claiming exemption. Ensure this is accurate as it dictates the applicable laws under which the exemption is filed.

- Indicate whether you are attaching the Multistate Supplemental form by checking the appropriate box if applicable.

- Choose whether this is a single purchase certificate or a blanket certificate. For a single purchase, provide the invoice or purchase order number. If you select a blanket certificate, understand it remains effective until canceled or if you make recurring purchases within a twelve-month period.

- Complete the purchaser information section, including the name and business address. Include your tax ID number, and if you do not have one, provide your FEIN or state-issued ID number.

- Proceed to enter the seller's information, including the seller's name and address, similar to how you filled in your own details.

- Select the reason for exemption. This is important as it identifies why the exemption is being claimed. Additionally, specify the type of business by circling the corresponding number.

- Sign and date the form in the provided areas, ensuring that the information declared is complete and accurate to your best knowledge.

- After filling out all the required fields, review the form for accuracy, then save any changes. You may choose to download, print, or share the completed form as needed.

Start filling out your Streamlined Sales Tax Certificate of Exemption online today.

Sales tax exemption certificates enable a purchaser to make tax-free purchases that would normally be subject to sales tax. The purchaser fills out the certificate and gives it to the seller. The seller keeps the certificate and may then sell property or services to the purchaser without charging sales tax.

Fill Streamlined Sales Tax Certificate Of Exemption

Exemption Certificate Form. This is a multistate form for use in the states listed. Not all states allow all exemptions listed on this form. Tax Agreement - Certificate of Exemption," and submit the document to the vendor. This is a multi-state form. Form E-595E (E595E), Streamlined Sales and Use Tax Certificate of Exemption, is to be used for purchases for resale or other exempt purchases. ST-5 SST Streamlined Sales and Use Tax Certificate of Exemption. Streamlined Exemption Certificate 2018. The Streamlined Sales and Use Tax Agreement became effective October 1, 2005. This agreement is a multi-state simplification of varying sales and use tax laws.

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.