Loading

Get Florida Surety Bonds

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Florida Surety Bonds online

Filling out the Florida Surety Bonds form online can streamline the bonding process for various projects. This guide provides clear instructions on how to complete each section of the form to ensure all necessary information is accurately submitted.

Follow the steps to complete the Florida Surety Bonds form correctly.

- Click the ‘Get Form’ button to access the Florida Surety Bonds form and open it for editing.

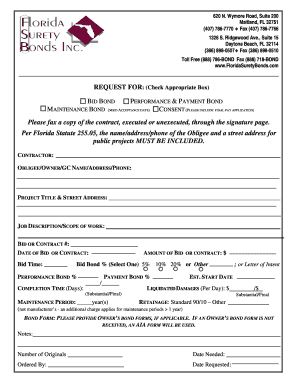

- Select the type of bond you are requesting by checking the appropriate box: bid bond, performance and payment bond, or maintenance bond. If applicable, include the acceptance date and any necessary consent details.

- Provide a faxed copy of the contract, whether executed or unexecuted, along with the signature page as required.

- Fill in the contractor's information, which includes their name, address, and phone number.

- Enter the obligee, owner, or general contractor's name, address, and phone number.

- Specify the project title and the street address where the project will take place.

- Detail the job description and the scope of work to provide clarity on the project's purpose.

- Input the bid or contract number, the date of the bid or contract, and the amount of the bid, including options for the percentage selection.

- Mention the estimated start date and the completion time in days. Additionally, specify any liquidated damages that may apply.

- Indicate the maintenance period in years, as well as the retainage percentage, noting any special conditions for maintenance periods exceeding one year.

- Provide details about the bond form, including the number of originals required and the date by which the bond is needed.

- Once all sections are completed, users can save changes, download, print, or share the form as needed.

Complete your documents online today for a seamless bonding experience!

At its simplest, a surety bond requires the surety to pay a set amount of money to the obligee if a principal fails to perform a contractual obligation. It also helps principals, typically small contractors, compete for contracts by reassuring customers that they will receive the product or service promised.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.