Loading

Get Sba Schedule Of Collateral (non-fillable) - Purchaseadd

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the SBA Schedule Of Collateral (Non-Fillable) - Purchaseadd online

Filling out the SBA Schedule Of Collateral (Non-Fillable) - Purchaseadd requires attention to detail and accuracy. This guide provides comprehensive, step-by-step instructions to help you complete the form effectively.

Follow the steps to successfully complete your SBA Schedule of Collateral form.

- Click ‘Get Form’ button to obtain the form and open it in your preferred online editor.

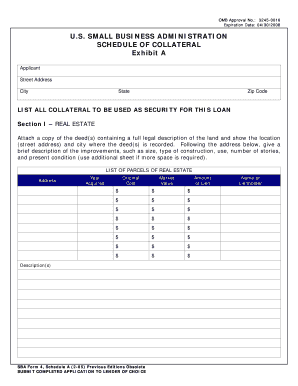

- Begin by filling out the 'Applicant' section, including your full name, street address, city, state, and zip code. Ensure all information is accurate and up-to-date.

- In 'Section I – Real Estate,' list all parcels of real estate used as collateral. Attach copies of the deed(s) that include the full legal description of the land. Indicate the location where the deed(s) is recorded.

- For each parcel, provide additional details such as year acquired, original cost, market value, and amount of lien. Include a brief description of improvements, such as size, type of construction, use, number of stories, and condition.

- In 'Section II – Personal Property,' list all items that are to be used as collateral, ensuring that any item with an original value greater than $5,000 includes its manufacturer, model, year, and serial number.

- Fill in the original cost, market value, and current lien balance for each item listed. If any items lack a serial number, be sure to clearly identify them.

- Review the declaration statement to confirm that all provided information is true and correct to the best of your knowledge. Be aware of the legal implications of providing false information.

- Finally, provide the names and dates where indicated. Once all sections are completed and verified, you may save changes, download, print, or share the form as necessary.

Complete the SBA Schedule Of Collateral form online to ensure a smooth processing of your loan application.

Collateral is an asset pledged to a lender until a loan is repaid. If the loan isn't repaid, the lender may seize the collateral and sell it to pay off the loan. Obvious forms of collateral include houses, cars, stocks, bonds and cash -- all things that are readily convertible into cash to repay the loan.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.