Loading

Get Hawaii Gewtarv5 General Excise / Use ... - State Legal Forms

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Hawaii Gewtarv5 General Excise / Use application changes form online

This guide provides a step-by-step approach to completing the Hawaii Gewtarv5 General Excise / Use application changes form online. Designed for users of all experience levels, it aims to simplify the process and clarify each section of the form for your convenience.

Follow the steps to accurately complete the form.

- Press the 'Get Form' button to obtain the form and open it in the editor.

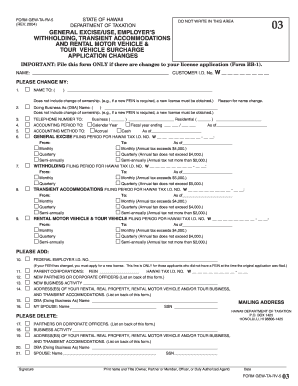

- Begin by filling in your name in the designated field, as well as your customer identification number (C.I.D. No.). Make sure to provide accurate information, as this is essential for processing your changes.

- If you need to change any of the details listed in the form, select the appropriate checkboxes for each change you wish to make, such as name, telephone number, or accounting method.

- For each change selected, enter the new details in the corresponding fields. For example, if changing your name, provide the new name in the designated area.

- Indicate the new accounting period and method by selecting the appropriate options from the provided choices (monthly, quarterly, semi-annually). Fill in the effective date for these changes.

- If applicable, provide details regarding transient accommodations or rental motor vehicles, including the filing period and corresponding tax identification numbers.

- For any new partners or corporate officers, list their names, titles, and addresses as required. Make sure to attach a separate list if there are more names than the form accommodates.

- As you complete the form, review all entries for accuracy to ensure there are no mistakes that could delay processing.

- Once all changes are complete, you can save your modifications, download a copy of the filled-out form, print it for your records, or share it as necessary.

Start completing your Hawaii Gewtarv5 General Excise / Use application changes form online today!

General Excise Tax The tax is imposed on the gross income received by the person en- gaging in the business activity. Activities subject to the tax include wholesaling, retailing, farming, services, construction contracting, rental of per- sonal or real property, business interest income, and royalties.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.