Loading

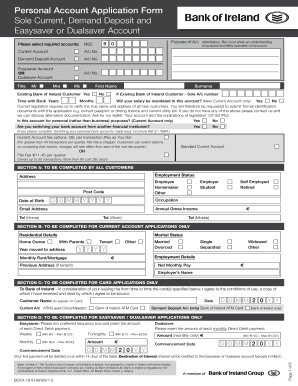

Get Personal Account Application Form Sole Current, Demand Deposit And Easysaver Or Dualsaver Account 9

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Personal Account Application Form Sole Current, Demand Deposit and Easysaver or Dualsaver Account 9 online

Filling out the Personal Account Application Form online can streamline your banking experience. This guide provides clear and detailed instructions for each section of the form, ensuring that users can confidently complete their application.

Follow the steps to successfully complete your Personal Account Application form.

- Click the ‘Get Form’ button to access the form and open it in your preferred editor.

- Select the purpose of the account from the mandatory options provided. Be sure to check the box that represents your understanding of the purpose and likely operation of the account.

- Indicate the type of account you wish to open by selecting from the options: Current Account, Demand Deposit Account, Easysaver Account, or Dualsaver Account. Input the corresponding account number as required.

- Fill in your personal details in the form, including your title, first name, surname, and contact information. Specify whether you are an existing Bank of Ireland customer.

- Provide relevant employment information, including your employment status, occupation, and annual gross income. Make sure to fill in your date of birth accurately.

- For a current account application, complete the residential details section, including home ownership status and marital status, as well as your current address and previous address if applicable.

- If applying for Easysaver or Dualsaver accounts, choose your preferred direct debit frequency and insert the amount for the payments.

- Read and agree to the authorisation and application consent sections before providing your signature. Ensure to date your signature accurately.

- Once all sections are completed, review your application for accuracy. Then, you can save changes, download, print, or share the form as required.

Complete your Personal Account Application Form online now for a swift banking experience.

A demand deposit account is just a different term for a checking account. ... Most demand deposit accounts (DDAs) let you withdraw your money without advance notice, but the term also includes accounts that require six days or less of advance notice.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.