Loading

Get Tax Withholding Certificate Form Irs452a - Frca Org

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Tax Withholding Certificate Form IRS452A - Frca Org online

Filling out the Tax Withholding Certificate Form IRS452A - Frca Org online is an essential step for ensuring accurate tax reporting. This guide provides clear, step-by-step instructions to help you successfully complete the form, making the process straightforward for users of all experience levels.

Follow the steps to complete the form accurately.

- Click the ‘Get Form’ button to obtain the Tax Withholding Certificate Form IRS452A and open it in the editor.

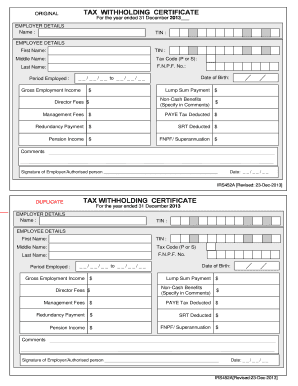

- Begin by filling in the employer details. Input the employer's name and tax identification number (TIN) in the designated fields.

- Next, complete the employee details section. Provide the employee’s first name, middle name (if applicable), last name, and TIN.

- Enter the employee's tax code (P or S) and F.N.P.F. number in the relevant fields.

- Record the period employed, specifying the start and end dates using the format provided.

- Indicate the gross employment income and other payments such as lump sum payment, director fees, management fees, redundancy payment, and pension income as applicable, entering each amount in the designated fields.

- Document any non-cash benefits in the comments section along with PAYE tax deducted and SRT deducted.

- Ensure all fields are accurately filled out. Finally, sign the form in the space provided for the employer or authorized person and enter the date.

- Once you have completed all sections, you can save your changes, download the form, print it, or share it as needed.

Start filling out your Tax Withholding Certificate Form IRS452A online today!

Form W-4 tells you, as the employer, the employee's filing status, multiple jobs adjustments, amount of credits, amount of other income, amount of deductions, and any additional amount to withhold from each paycheck to use to compute the amount of federal income tax to deduct and withhold from the employee's pay.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.