Loading

Get Zs Qu1

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Zs Qu1 online

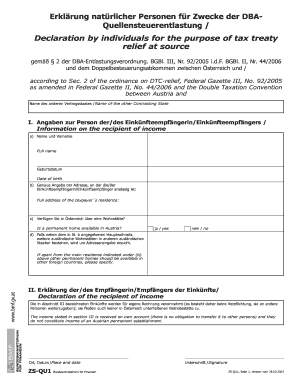

Filling out the Zs Qu1 form online is a crucial step for individuals seeking tax treaty relief. This guide will provide you with a comprehensive overview of the form's components and clear instructions to help you complete it efficiently.

Follow the steps to successfully complete the Zs Qu1 form online.

- Click ‘Get Form’ button to obtain the form and open it in the editor.

- In Section I, provide your personal information. Enter your full name and date of birth in the designated fields. Ensure accuracy to avoid processing issues.

- In Section II, confirm that the income stated is received on your own account and is not related to an Austrian permanent establishment. Ensure you sign and date the declaration.

- Section IV requires a certificate of residence from the tax administration of your state. Confirm your residency status as per the Double Taxation Convention.

- Once all sections are filled out, review the form for accuracy. Save your changes, then download, print, or share the completed form as required.

Take the next step in your tax relief process by completing the Zs Qu1 form online today.

Service Technical Tax is withheld at the rate of 20% on payments made by an Austrian resident for technical services performed in Austria by a non-resident without an Austrian permanent establishment. Below is a discussion of domestic withholding tax rules for most of the common cross border payments.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.