Loading

Get Ui2 3 Form

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Ui2 3 Form online

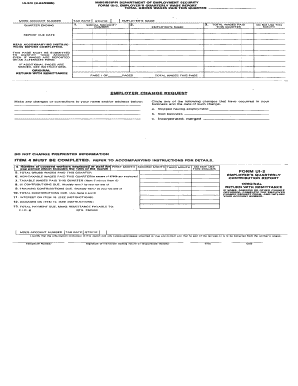

Filling out the Ui2 3 Form online can seem daunting, but with this guide, you can complete it efficiently and accurately. This document is vital for reporting employee wages and contributions, ensuring compliance with state requirements.

Follow the steps to successfully complete the Ui2 3 Form online.

- Click ‘Get Form’ button to obtain the form and open it in the editor.

- Begin with Item 1 by entering the employee's Social Security Number. If an employee does not have an SSN, provide only the employee’s name while they await their number.

- In Item 2, provide each employee's name, which should include two initials followed by their full last name.

- For Item 3, enter the total gross wages paid to each employee for Mississippi employment. This includes all cash payments and the cash value of non-cash payments. If uncertain about wage exemptions, reach out to the Mississippi Department of Employment Security.

- If you need more space for additional employees, use a separate plain white sheet of paper formatted to 8 ½” X 11”. Include SSN, employee names, and the total wages for that page, then attach this to the Ui2 3 Form and report the total wages at the form's top.

- Proceed to Item 4 where you enter the total number of employees, both full-time and part-time, for the payroll period including the 12th day of each month during the quarter. Enter zero if there was no employment during this period.

- In Item 5, report the total gross wages paid to employees for Mississippi employment, ensuring it aligns with the total from Item 3.

- Calculate non-taxable wages in Item 6. The first $7,000 of salary per employee within a calendar year is taxed; any amount exceeding this is reported here.

- For Item 7, subtract the non-taxable wages reported in Item 6 from the total gross wages in Item 5 to find the taxable wages.

- In Item 8, multiply the taxable wages from Item 7 by your Unemployment Insurance Contribution Rate.

- Next, for Item 9, multiply the taxable wages from Item 7 by your Training Contribution Rate.

- Add the results from Items 8 and 9 for the Total Contributions Due in Item 10.

- Interest is calculated in Item 11 based on a rate of 1% per month from the report due date to the payment date, applied to the total contributions due.

- Item 12 involves calculating damages for late filing. If filing after 60 days past the due date, include ten percent of the contributions due. If a final notice of assessment has been previously issued, apply the same ten percent penalty.

- Finally, in Item 13, sum the totals from Items 10, 11, and 12. Make your payment to the Mississippi Department of Employment Security.

Complete your Ui2 3 Form online to ensure timely and compliant submissions.

Submit this form to the nearest SSS branch office together with the following supporting documents, whichever is applicable. a. Maternity Notification (MN) duly received by SSS prior to delivery/miscarriage/procedure or "Maternity Notification Submission Confirmation" (if filed thru the SSS Website or SSIT).

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.