Loading

Get Form Dr 15dss

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Form Dr 15dss online

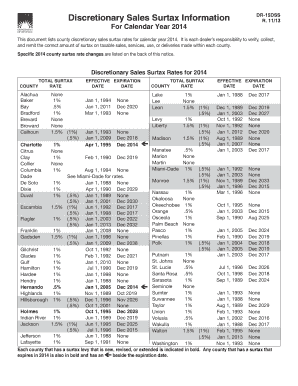

Filling out the Form Dr 15dss online can seem complex, but this guide will provide you with clear steps to complete it efficiently. This form is essential for reporting discretionary sales surtax rates for various counties in Florida.

Follow the steps to complete the Form Dr 15dss online.

- Press the ‘Get Form’ button to acquire the form and open it in your preferred online platform.

- Review the introductory information regarding discretionary sales surtax. Ensure you understand the purpose of the form and your responsibilities as a dealer.

- Locate the section where you must input the county information. Identify the correct county for your transactions and refer to the corresponding surtax rate listed on the form.

- Fill in the total surtax rate applicable to the county where you are conducting business. Double-check that this rate aligns with the current surtax rates listed on the form.

- If applicable, complete additional sections related to specific county rate changes or exemptions. Make sure to provide accurate information based on transaction details.

- After filling out all required fields, review the entire form for any missing information or errors. This will help ensure accuracy and compliance.

- Once you confirm that all details are correct, save your changes. You can choose to download, print, or share the completed form as necessary.

Start completing your Form Dr 15dss online today for a smooth filing experience.

The state sales tax rate in Florida is 6.000%. With local taxes, the total sales tax rate is between 6.000% and 8.500%. Florida has recent rate changes (Sat Feb 01 2020). Select the Florida city from the list of popular cities below to see its current sales tax rate.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.