Loading

Get Ap-199 Texas Application For Organizations Engaged Primarily In Performing Charitable Functions And

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Ap-199 Texas Application For Organizations Engaged Primarily In Performing Charitable Functions And online

Filling out the Ap-199 Texas Application is essential for organizations desiring to perform charitable functions in Texas. This guide provides clear, step-by-step instructions to help you navigate the online application process, ensuring that you complete the form accurately and efficiently.

Follow the steps to fill out the Ap-199 form online successfully.

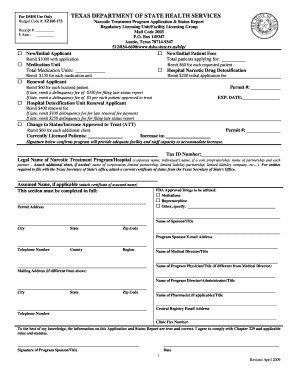

- Click the ‘Get Form’ button to obtain the application form and open it in the designated editor.

- Begin filling out your organization's legal name. This should reflect the name as registered with the Texas Secretary of State, or if applicable, the individual's name if it is a sole proprietorship.

- Provide your Tax ID Number in the designated field. This ensures proper identification for tax purposes.

- Fill in the Permit Address, ensuring it is complete with the street, city, state, and ZIP code.

- Specify the FDA approved drugs that your organization will utilize, such as , , or other specified medications.

- Enter the name, title, and contact information of the program sponsor, including their email address and telephone number.

- List the names and titles of key medical and administrative personnel involved in the narcotic treatment program, including the Medical Director, Program Physician, and Pharmacist.

- Confirm your agreement by signing and dating the application, indicating that all provided information is accurate and you comply with relevant laws.

- Once all fields are completed, review your entries for accuracy. You can then save changes, download, print, or share the form as required.

Begin your application process today by completing the Ap-199 form online!

Property Tax Exemption for Organizations Primarily Engaged in Charitable Activities. Property tax in Texas is a locally assessed and locally administered tax. There is no state property tax. An organization engaged primarily in charitable activities may be eligible for a local property tax exemption.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.