Loading

Get Form Ap 204

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Form Ap 204 online

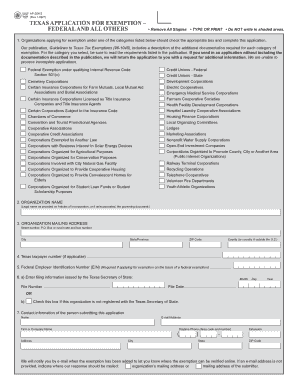

Filling out the Form Ap 204 is essential for organizations seeking tax exemptions in Texas. This guide will provide you with clear, step-by-step instructions to efficiently complete the form online.

Follow the steps to successfully complete the Form Ap 204.

- Click ‘Get Form’ button to access the document and open it for editing.

- Review the types of exemptions provided and check the appropriate box that applies to your organization. Ensure you understand the documentation required for the selected category from the associated guidelines.

- In the second section, enter the legal name of your organization as specified in the Articles of Incorporation or governing document.

- Provide the organization mailing address, including the street number, city, state, ZIP code, and county or country if located outside of the U.S.

- If applicable, enter the Texas taxpayer number. This might not be necessary for all organizations.

- Fill in the Federal Employer Identification Number (EIN) if you are applying based on a federal exemption.

- Indicate the filing information issued by the Texas Secretary of State, including the File Number and the corresponding filing date. Alternatively, check the box if your organization is not registered with the Texas Secretary of State.

- Provide contact information for the person submitting the application: name, email address, firm or company name, mailing address, and daytime phone number.

- Ensure that your email address is included for notification purposes. If not, specify the desired mailing address for the response.

- After filling out the form, review all entered information for accuracy. Save changes, download, print, or share the completed form as needed.

Complete your Form Ap 204 online today to ensure your organization secures the necessary tax exemptions.

As per section 80U, anyone suffering from a disability is eligible to get an extra income tax exemption from their taxable income. In such cases, Rs 50,000 can be deducted from their taxable income. Moreover, in the case of severe disabilities, the deductions can even be Rs 1, 00,000.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.