Loading

Get Ap-209 Application For Exemption - Religious And Religion Based ... - Window Texas

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the AP-209 Application For Exemption - Religious Organization online

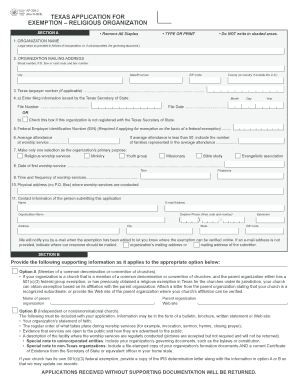

Filling out the AP-209 Application For Exemption - Religious Organization is an important step for nonprofit religious organizations seeking exemption from Texas sales tax, hotel occupancy tax, and franchise tax. This guide provides a comprehensive overview of the form's components and offers clear instructions for completing it online.

Follow the steps to successfully complete your application online.

- Press the ‘Get Form’ button to access the AP-209 Application For Exemption document in your preferred document editor.

- Begin by filling out Section A, which includes the legal name of your organization as stated in your Articles of Incorporation, or the governing document if unincorporated. Complete all required fields, such as the mailing address, city, state, and ZIP code.

- Enter the Texas taxpayer number if applicable. If your organization is registered, provide the filing information issued by the Texas Secretary of State, including the file number and file date.

- Input the federal Employer Identification Number (EIN) if your application is based on a federal exemption. Also, provide details about average attendance during worship services, including family representation if attendance is less than 50.

- Make a selection for the organization's primary purpose by marking one of the options provided, such as religious worship services or ministry.

- Indicate the date of the first worship service, including its time and frequency of occurrence, and include the physical address where worship services are held.

- Provide contact information for the person submitting the application, including their name, email address, and phone number. Ensure that the email address is accurate for notification purposes.

- In Section B, provide supporting documentation as applicable. For Option A, include information from the parent organization if affiliated. For Option B, provide a detailed statement of faith, details of worship services, evidence of public access, and a description of your facilities.

- Review the completed application for accuracy and ensure all required documents are attached to prevent delays.

- Once you have filled out all sections and attached the necessary documentation, submit the application and supporting documents to the Comptroller of Public Accounts at the specified address.

- After submission, await confirmation from the Comptroller's office regarding the status of your application. You will be notified via email if provided.

- Finally, you can save any changes made to the form, download it for your records, print copies as needed, or share it with relevant stakeholders.

Start your application process by filling out the AP-209 form online today.

How do we apply for an exemption? To apply for franchise and sales tax exemptions, complete and submit Form AP-204, Texas Application for Exemption – Federal and All Others (PDF) to the Comptroller's office. Include a copy of the IRS-issued exemption determination letter with any addenda.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.