Loading

Get Application - Ramsey County, Minnesota - Co Ramsey Mn

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Application - Ramsey County, Minnesota - Co Ramsey Mn online

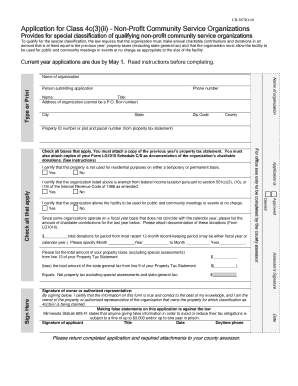

This guide provides clear and supportive instructions for users filling out the Application for Class 4c(3)(ii) – Non-Profit Community Service Organizations in Ramsey County, Minnesota. By following these steps, you can complete the document efficiently and accurately.

Follow the steps to complete your application online.

- Press the ‘Get Form’ button to access the application and open it in your preferred editor.

- Begin by filling in your personal information as the person submitting the application. This includes your name, title, phone number, and address of the organization (please note that a P.O. Box number is not acceptable).

- Provide the name of the organization and ensure it is entered accurately.

- Enter the Property ID number or plat and parcel number, which can be found on your property tax statement.

- Indicate all relevant selections under the 'Check all that apply' section, ensuring you understand the criteria that may affect your eligibility.

- List the amount of charitable contributions made during the last year and attach the required documentation, including the Form LG1010, as proof of these donations.

- Calculate and fill in the total amount of property taxes, excluding special assessments, from your property tax statement.

- Complete the certification section by signing and dating the application, confirming that the information you have provided is correct.

- Attach all required documents, including the previous year’s property tax statement and Forms LG1010, before submitting your application.

- Finalize your submission by saving changes or printing the form as necessary to maintain a record for your files.

Complete your application online today to ensure timely submission before the May 1 deadline.

Your countable net income is determined after allowing certain deductions for shelter, dependent care and some other expenses. Your monthly SNAP benefit is calculated by subtracting 30% of your countable net income from the maximum SNAP benefit for your household size.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.