Get Minnesota M500 Form 2014

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Minnesota M500 Form 2014 online

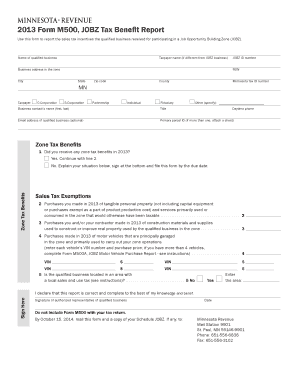

The Minnesota M500 Form 2014 is essential for reporting sales tax incentives received by qualified businesses participating in the Job Opportunity Building Zone (JOBZ) program. This guide will provide you with step-by-step instructions on completing the form online.

Follow the steps to successfully fill out the Minnesota M500 Form 2014 online.

- Click ‘Get Form’ button to obtain the form and open it for editing.

- Begin by entering the name of your qualified business. If the taxpayer name differs from the business name, provide that information as well.

- Identify the taxpayer type by selecting one of the options: C-Corporation, S-Corporation, Partnership, Individual, Fiduciary, or Other (specify).

- Provide contact details of the business, including the primary contact's name, title, daytime phone number, and an optional email address for correspondence.

- Indicate whether your business received any zone tax benefits in 2013 by checking 'Yes' or 'No'. If 'No', provide a brief explanation.

- For lines 2 through 4, enter details regarding purchases of tangible personal property and construction materials that were primarily used in the zone.

- Complete line 5 to note if your business is located in an area with a local sales and use tax, and enter the specified area accordingly.

- At the end of the form, ensure that you, as an authorized representative, sign and date the document to validate it.

- After completing the form, save any changes made. You can download, print, or share the form as needed.

Complete the Minnesota M500 Form 2014 online and ensure your business stays compliant with the JOBZ program requirements.

Corporations doing business in Minnesota that have elected to be taxed as S corporations under IRC section 1362 must file Form M8. Who Must File. The entire share of an entity's income is taxed to the shareholder, whether or not it is actually distributed. 2022 S Corporation Form M8 Instructions revenue.state.mn.us https://.revenue.state.mn.us › files › m8_inst_22 revenue.state.mn.us https://.revenue.state.mn.us › files › m8_inst_22

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.