Loading

Get Tobacco Tax Licensing And Filing Information - Minnesota ... - Revenue State Mn

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Tobacco Tax Licensing and Filing Information - Minnesota online

This guide provides clear and concise instructions on how to complete the Tobacco Tax Licensing and Filing Information form in Minnesota. Designed for users with varying levels of experience, the following steps will assist you in accurately filling out the form online.

Follow the steps to complete the Tobacco Tax Licensing form online:

- Press the ‘Get Form’ button to access the form and open it in an editor for completion.

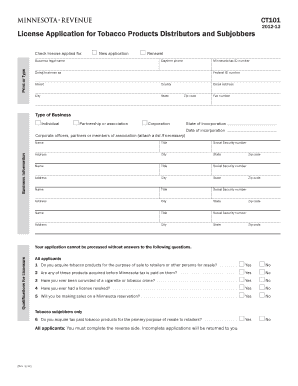

- Identify the type of license you are applying for by selecting either 'new application' or 'renewal'.

- Enter your business legal name as registered, along with your daytime phone number and Minnesota tax ID number.

- Provide your 'doing business as' name, if applicable, and include your federal ID number.

- Fill in your business address, including street, city, state, and zip code.

- Select the type of business structure you are operating under: individual, partnership, association, or corporation, and indicate the state of incorporation.

- If applicable, provide the date of incorporation and a list of corporate officers, partners, or members of the association.

- Respond to the qualifications for licensure questions. Ensure that all questions are answered as required.

- If you are a distributor, list the name and address of each manufacturer from whom you purchase tobacco products.

- Enter the date of your first untaxed tobacco purchase if applicable.

- Review the fees for the type of license you are applying for and ensure correct payment is included.

- Sign the application, including your title and the date, confirming the information is accurate.

- Finally, save your changes, and then download, print, or share the completed form as needed.

Complete your Tobacco Tax Licensing application online now.

If you owe state taxes, you'll need to make your payment directly to the state's tax authority. For many states, you can pay online through Credit Karma Tax by providing your bank account information for a direct debit.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.