Loading

Get Rp-5217 Real Property Transfer Report - Co Oswego Ny

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the RP-5217 Real Property Transfer Report - Co Oswego Ny online

The RP-5217 Real Property Transfer Report is an essential document used to record the transfer of real property in approved counties in New York State. This guide will provide clear and comprehensive instructions on how to accurately complete this form online, ensuring all necessary information is included.

Follow the steps to complete the RP-5217 form online

- Select the ‘Get Form’ button to access the RP-5217 form and open it in your preferred digital format.

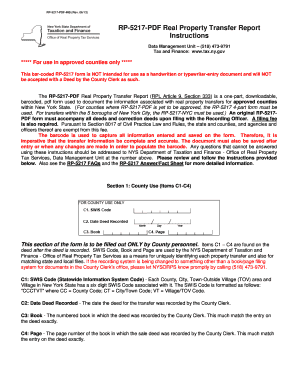

- Begin with Section 1 (County Use), ensuring that only county personnel complete items C1-C4 based on information from the deed.

- In Section 2 (Property Information), provide details such as the property location, buyer's name, tax billing address, and number of parcels being transferred.

- For items 4A to 4C, indicate if any subdivision questions are applicable if a part of a parcel is involved.

- Continue with items 5 to 10, specifying property size, seller name, property use, ownership type (if applicable), and confirmation if the property is located in an agricultural district.

- Move to Section 3 (Sale Information) and fill in sale contract date, date of sale/transfer, full sale price, and any personal property included in the sale.

- Check applicable conditions of sale in item 15 that may affect the transfer.

- In Section 4 (Assessment Information), enter assessment roll year, total assessed value, property class code, school district name, and tax map identifiers.

- Complete the certification section by obtaining the required signatures from both buyer and seller, along with their contact information.

- Review all entered information for accuracy. Save the completed form and proceed to download, print, or share as needed.

Complete your RP-5217 Real Property Transfer Report online today for a smooth property transfer process.

Under New York law, a person who wishes to update her name on a deed must execute a new deed and record it with the county clerk where the property is located. Obtain or purchase a New York warranty deed form.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.