Loading

Get Cecil County Property Transfer Record Form - Ccgov

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Cecil County Property Transfer Record Form - Ccgov online

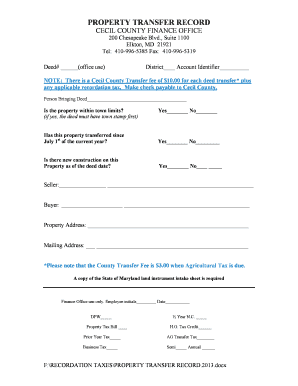

Filling out the Cecil County Property Transfer Record Form is essential for anyone involved in a property transfer in Cecil County. This guide will provide you with clear, step-by-step instructions to ensure that you complete the form accurately and efficiently.

Follow the steps to complete the online form

- Use the ‘Get Form’ button to access the Property Transfer Record Form and open it in your preferred document editor.

- Begin by entering the Deed number in the designated field, ensuring it’s accurate for office use.

- Fill in the District and Account Identifier fields, providing the necessary identifying information related to the property.

- Indicate whether the property is within town limits by selecting 'Yes' or 'No'. If 'Yes', ensure that the deed has the necessary town stamp.

- Answer the question about whether the property has transferred since July 1st of the current year by selecting 'Yes' or 'No'.

- State if there is new construction on the property as of the deed date by marking 'Yes' or 'No'.

- Provide the Seller's information, ensuring to fill in all required fields including their name and address.

- Enter the Buyer's information accurately, including their name and address.

- List the Property Address and the Mailing Address where communications can be sent regarding the property transfer.

- Review any notes regarding fees, such as the $10 transfer fee or any applicable recordation taxes, and prepare your payment accordingly.

- Finalize the form by confirming all entered details are correct and complete, then save any changes you made.

- You may choose to download, print, or share the completed form as needed for your records or submission.

Start completing the Cecil County Property Transfer Record Form online today for a smooth property transfer process.

Although real estate transfer taxes are collected by your respective county, the rates remain constant throughout the state. The fees amount to $1.85 per $500, based on the amount that the property sold for. For example, if the property sold for $200,000, then $740 in real estate transfer taxes would be due.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.