Loading

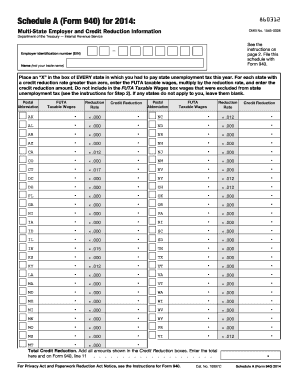

Get Schedule A (form 940) For 2013: 860312 Multi-state Employer And Credit Reduction Information Omb No

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Schedule A (Form 940) For 2013: 860312 Multi-State Employer And Credit Reduction Information OMB No online

This guide provides a comprehensive overview on how to accurately complete Schedule A (Form 940) for 2013, focusing on multi-state employer and credit reduction information. It is designed to support users at all levels of experience with clear and concise instructions for each component of the form.

Follow the steps to fill out your Schedule A (Form 940) accurately.

- Click ‘Get Form’ button to obtain the form and open it in the editor.

- Begin by entering your employer identification number (EIN) and name in the designated fields, ensuring the name reflects your legal business name and not the trade name.

- In the state section, mark an ‘X’ in every box for the states where you paid state unemployment taxes during the year, including the District of Columbia, Puerto Rico, and the U.S. Virgin Islands.

- For each state that has a credit reduction rate greater than zero, enter your total FUTA taxable wages in the respective boxes. Remember to exclude any wages not subject to state unemployment tax.

- Next, for each state with a credit reduction, multiply the FUTA taxable wages entered by the respective reduction rate to calculate the credit reduction amount.

- Add all the amounts from the Credit Reduction boxes to compute the Total Credit Reduction, and enter this total in the designated box.

- Lastly, ensure to report the total credit reduction amount on Form 940, specifically in line 11. Save any changes, and when completed, download, print, or share your form as needed.

Complete your Schedule A (Form 940) online today to ensure accurate filing.

Form 940 reports the amount of Federal Unemployment Tax (FUTA) an employer must pay. Employers who've paid $1,500 or more to any W-2 employee OR had at least 1 employee for 20 or more weeks of the year must file Form 940.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.