Loading

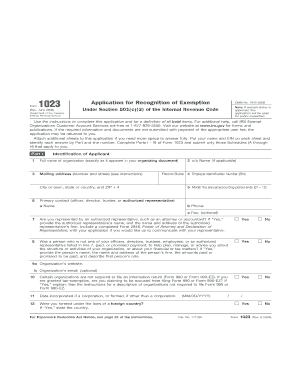

Get Form 1023 (rev. June 2006) - Foundation Source

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to use or fill out the Form 1023 (Rev. June 2006) - Foundation Source online

Filling out the Form 1023 is a crucial step for organizations seeking recognition of tax-exempt status under Section 501(c)(3) of the Internal Revenue Code. This guide provides clear, step-by-step instructions for completing the form online, ensuring a smooth and efficient application process.

Follow the steps to complete the Form 1023 online.

- Press ‘Get Form’ button to access the online version of the Form 1023 and open it in the editor.

- Begin with Part I, identification of the applicant. Fill in the full legal name of the organization exactly as it appears in your organizing documents. Provide the mailing address along with the Employer Identification Number (EIN) and contact details.

- Complete Part II regarding the organizational structure. Indicate whether your organization is a corporation, limited liability company, or another type and attach the necessary documentation, such as articles of incorporation or association.

- Move to Part III, ensuring that your organizing document includes the required provisions for tax-exempt organizations. Describe the purpose of your organization and refer to specific sections of your organizing document.

- In Part IV, provide a narrative description of your past, present, and planned activities. This should include details about the services or programs your organization offers.

- Fill in Part V, which records compensation and financial arrangements with your officers and trustees. Provide names, titles, and compensation details.

- Continue to Part IX for the financial data component, providing statements of revenue and expenses for the required number of years, as directed, based on your organization's existence.

- Complete Part X, indicating your public charity status, and prepare any corresponding schedules required.

- In Part XI, specify the user fee payment that corresponds with your organization's average annual gross receipts and prepare your payment.

- Review all completed sections and ensure that each field is accurate and complete. Save changes, and then you can choose to download, print, or share the form.

Start filling out your Form 1023 online today to ensure your organization's tax-exempt status is recognized!

Mining is the term used to describe the process of creating cryptocurrency. Transactions made with cryptocurrency need to be validated, and mining performs the validation and creates new cryptocurrency. Mining uses specialized hardware and software to add transactions to the blockchain.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.