Loading

Get 471, Application For Deferment Of Summer Taxes - State Of Michigan

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the 471, Application For Deferment Of Summer Taxes - State Of Michigan online

This guide provides a comprehensive overview for users seeking to complete the 471, Application For Deferment Of Summer Taxes for the State of Michigan online. By following these steps, you can accurately fill out the form and ensure your application is submitted correctly.

Follow the steps to fill out the 471 form online effectively.

- Press the ‘Get Form’ button to access the document, allowing you to open and interact with it in your preferred online format.

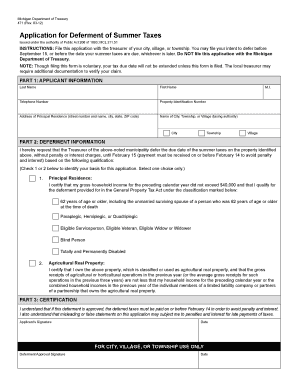

- Begin by completing Part 1, Applicant Information. Provide your last name, first name, middle initial, telephone number, property identification number, and the address of your principal residence, including street number, city, state, and ZIP code. Indicate the name of your tax jurisdiction whether it is a city, township, or village.

- Proceed to Part 2, Deferment Information. Select one of the two qualifying bases for deferment. If qualifying as a principal residence, check the appropriate box indicating your eligibility based on income and age or disability status. Ensure that your gross household income did not exceed $40,000 in the preceding calendar year.

- If qualifying under the agricultural category, check the corresponding box and provide necessary details about your agricultural property and confirm that your gross receipts meet the income criteria.

- In Part 3, Certification, read the terms carefully. Confirm your understanding of the requirements for deferred tax payments and the consequences of any misleading information. Sign and date the application to validate your request.

- After completing all sections of the form, make sure to review your entries for accuracy. Once verified, you can save the document, download it for your records, or print it for submission.

Begin filling out your 471 Application For Deferment Of Summer Taxes online today to ensure timely processing!

Related links form

Seniors may claim the homestead property tax credit up to four years from the annual date (April 15) set for filing the claim. The credit may be allowed if a senior meets the following criteria: a. Applicant or spouse of applicant must reach age 65 by December 31 of the tax year.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.