Loading

Get Mileage Log

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Mileage Log online

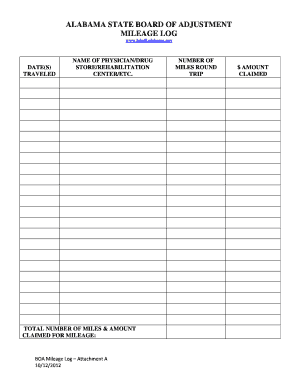

Filling out the Mileage Log is an essential step for documenting travel expenses. This guide provides detailed instructions on how to complete the Mileage Log online effectively and accurately.

Follow the steps to complete your Mileage Log with ease.

- Click the ‘Get Form’ button to obtain the Mileage Log and open it in your editor of choice.

- In the first section, 'Date(s) Traveled,' enter the specific dates of your travel in the format required by the form.

- Next, in the 'Name of Physician/Drug Store/Rehabilitation Center/Etc.' field, provide the name of the relevant entity you visited during your travel.

- In the 'Total Number of Miles & Amount Claimed for Mileage' section, calculate and input the total distance traveled, as well as the corresponding reimbursement amount.

- For 'Number of Miles Round Trip,' indicate the total miles for the round trip, ensuring that your calculations are accurate.

- Finally, review all entered information for accuracy, then save your changes, download the completed form, print it, or share it as needed.

Start completing your Mileage Log online today for efficient documentation of your travel expenses.

The IRS does not require odometer readings for every trip. Let's go over the reporting requirements for mileage deduction.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.