Loading

Get Lincoln 403b Rollover Form

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Lincoln 403b Rollover Form online

Filling out the Lincoln 403b Rollover Form online can be a straightforward process if you follow the provided instructions carefully. This guide aims to walk you through each section of the form, ensuring you have a clear understanding of what information is required.

Follow the steps to complete the Lincoln 403b Rollover Form online.

- Press the ‘Get Form’ button to access the Lincoln 403b Rollover Form and have it opened in the online editor.

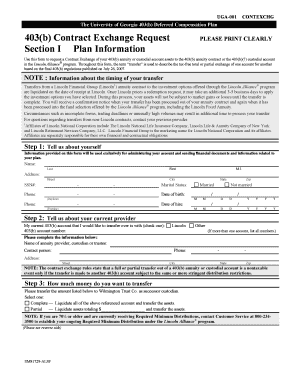

- Provide your personal information in Section I, which includes your name, address, Social Security number, marital status, phone numbers, and date of birth. Ensure all fields are filled out clearly.

- In Section II, tell about your current provider by selecting whether it's Lincoln or another provider. Enter the account number and provide the name of the annuity provider, contact person, and their phone number.

- Indicate the amount you want to transfer in Section III. Choose between liquidating all assets or a partial amount, and specify the exact dollar amount for a partial transfer.

- Have your existing provider complete the transfer breakdown in Section IV. Include dollar amounts for various contribution types, noting special cases for Roth and after-tax contributions.

- In Section V, consent to electronic delivery if you choose. Enter a valid email address to receive documents online; otherwise, you will receive paper documents by mail.

- Fill out Section VI by signing your name and dating the form. Ensure that you understand the transfer agreement and that it contains only funds from another 403b account.

- Return the completed form to the designated contact provided in your instructions, either by mail or as specified.

Complete your Lincoln 403b Rollover Form online for a smooth transfer process.

If your old 401(k) or 403(b) has limited investing options, you can often access a more diversified, low cost portfolio by rolling over your account into an IRA. ... As long as you roll over your employer-sponsored plan correctly, there should be no tax consequences of moving those funds into an IRA.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.