Loading

Get Ri W3

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Ri W3 online

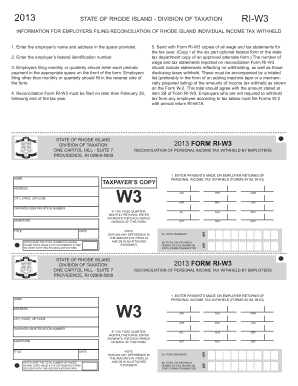

Completing the Ri W3 form is essential for employers to reconcile the Rhode Island individual income tax withheld from employees. This guide provides clear, step-by-step instructions to help users accurately complete the form online.

Follow the steps to successfully fill out the Ri W3 form online.

- Press the ‘Get Form’ button to access the Ri W3 form and open it in your preferred online editor.

- Enter the employer's name and address in the designated areas provided on the form.

- Input the employer’s federal identification number accurately to ensure proper identification.

- If filing monthly or quarterly, list each periodic payment in the appropriate spaces on the front of the form. If you are filing on a different schedule, complete the reverse side of the form as instructed.

- Ensure that the Ri W3 form is submitted no later than February 28 of the year following the end of the tax year.

- Attach copies of all wage and tax statements (Form W-2) for the tax year, including those reflecting no withholding. Include a total list of amounts for income tax withheld, matching the amount stated at item 2B of Form Ri W3.

- Confirm that Form W-2 is complete with the employee’s details, total wages, and the Rhode Island tax withheld clearly identified.

- Do not enclose any remittance for taxes withheld with the wage and tax statements. This should be mailed separately with the employer's return form.

- If using electronic or mechanical listings, remember to obtain prior written approval from the Rhode Island Division of Taxation for the tape formats.

- Review the completed form for accuracy, making any necessary corrections, and then save your changes, download, print, or share the form as needed.

Complete your Ri W3 form online effortlessly today!

Form RI-W3 - Transmittal of Wage and Tax Statements. INFORMATION FOR EMPLOYERS FILING TRANSMITTAL OF WAGE AND TAX STATEMENTS. 1. The employer's name and address should be pre-printed on the form.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.