Loading

Get Employee Expensable Change Form

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the EMPLOYEE EXPENSABLE CHANGE FORM online

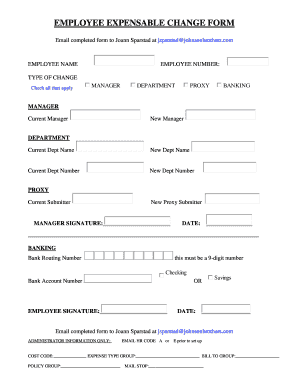

Filling out the Employee Expensable Change Form online is straightforward and ensures that necessary changes related to your employment and banking information are processed efficiently. This guide will provide detailed instructions on how to complete each section of the form step by step.

Follow the steps to successfully complete the form.

- Click ‘Get Form’ button to obtain the form and access it for editing.

- Enter your full name in the 'Employee Name' field to ensure correct identification.

- Input your unique employee number in the 'Employee Number' field. This helps to link your form to your records.

- In the 'Type of Change' section, check all applicable boxes to highlight the changes you are submitting, such as manager or department changes.

- For the 'Manager' section, provide the name of your current manager and the name of your new manager if applicable.

- In the 'Department' section, fill in your current department name and number, along with the new department details if applicable.

- If you need to designate a proxy submitter, complete the 'Proxy' section with the necessary information, including current and new submitters.

- Complete the banking section by entering your bank routing number (a 9-digit number) and your bank account number. Specify if it is a checking or savings account.

- Sign the form in the 'Employee Signature' field and date it to confirm the accuracy of the provided information.

- If you are an administrator, complete the required fields in the 'Administrator Information Only' section, including cost code and policy group.

- Once all sections are filled out, review your entries for accuracy. Save your changes, then download, print, or share the completed form as needed.

Start filling out your forms online today for a seamless documentation process.

No, an Employer should not change your Federal Withholdings without your consent unless they receive a letter from the IRS stating they must do so. ... Other than an order from the IRS, your Employer should not change your Federal Withholdings except when you submit a new Form W-4.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.