Loading

Get Tangible Personal Property Form - Qpublic - Qpublic

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Tangible Personal Property Form - QPublic - Qpublic online

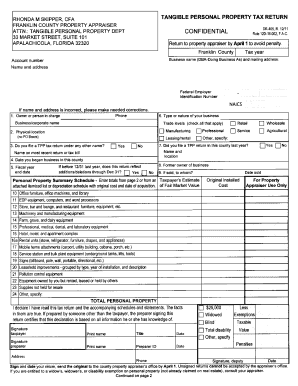

This guide provides comprehensive instructions for filling out the Tangible Personal Property Form accurately and efficiently. The process is designed to be user-friendly for individuals and businesses managing tangible personal property to ensure compliance with local regulations.

Follow the steps to complete your Tangible Personal Property Form effectively.

- Click ‘Get Form’ button to obtain the form and open it in the editing interface.

- Begin by entering the tax year in the designated field at the top of the form. This identifies the relevant year for which the taxes are being reported.

- Input the business name (doing business as) and the mailing address in the designated fields. Ensure that your address is complete and accurate.

- Fill in your account number, followed by your name and address. If corrections are needed, make adjustments accordingly.

- Provide your Federal Employer Identification Number, if applicable. This helps identify your business for tax purposes.

- Select the type or nature of your business by checking the appropriate boxes. Feel free to elaborate in the 'other' section if necessary.

- Indicate if you have filed a Tangible Personal Property (TPP) tax return under any other name in the previous year. Provide details should this apply.

- Report the date you began your business in the county and your fiscal year-end if applicable.

- Complete the property summary schedule by entering the totals from page 2 or attaching an itemized list with the original cost and acquisition date for each property owned.

- If you've disposed of property, indicate to whom it was sold and the sale date.

- Fill out the section for property appraisal use only, following the guidelines to estimate the fair market value of each category as requested.

- Review the details to ensure accuracy before signing and dating your return.

- Submit the original form to your county property appraiser's office before the April 1 deadline to avoid penalties. Keep a copy for your records.

- Choose to save changes, download, print, or share the completed form as appropriate for your needs.

Complete your Tangible Personal Property Form online today to ensure compliance and avoid penalties.

Personal property can be characterized as either tangible or intangible. Examples of tangible personal property include vehicles, furniture, boats, and collectibles. Stocks, bonds, and bank accounts fall under intangible personal property.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.