Loading

Get Nys Py Notice Work Agreements Ls 309

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Nys Py Notice Work Agreements Ls 309 online

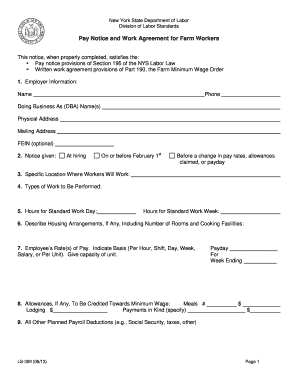

Completing the Nys Py Notice Work Agreements Ls 309 form is essential for documenting the pay and work conditions of farm workers in New York. This guide provides a clear, step-by-step approach for filling out the form online, ensuring compliance with state labor laws.

Follow the steps to complete the Nys Py Notice Work Agreements Ls 309 form online.

- Click the ‘Get Form’ button to access the Nys Py Notice Work Agreements Ls 309 form in your preferred document editor.

- Fill in the employer information section with the name, phone number, Doing Business As (DBA) name(s), physical address, mailing address, and optionally, the Federal Employer Identification Number (FEIN).

- Indicate when the notice is being given by selecting one of the options: at hiring, on or before February 1st, or before a change in pay rates, allowances claimed, or payday.

- Provide the specific location where workers will perform their tasks.

- List the types of work that will be performed by the workers.

- Document the hours for the standard workday and the standard workweek.

- If applicable, describe housing arrangements, including the number of rooms and cooking facilities provided.

- State the employee’s rate(s) of pay, including the basis for payment (per hour, shift, day, week, salary, or per unit) and specify the capacity of the unit.

- If there are any allowances to be credited towards the minimum wage, indicate the details for meals, lodging, and payments in kind.

- Mention the designated payday and the week ending date relevant to the payroll.

- List any planned payroll deductions, such as Social Security, taxes, or others.

- Outline the benefits to be provided by the employer, including sick leave, vacation, personal leave, holidays, and any other benefits.

- Indicate the approximate period of employment, specifying the start and end dates.

- Describe any non-economic terms and conditions of employment, such as transportation availability, medical services, childcare, and schooling.

- State whether overtime will be paid at a higher rate, and if so, specify the agreement with the worker.

- Ensure that the employee acknowledges receipt of the pay notice by filling in their name, signing, and indicating their primary language.

- Enter the preparer's name, title, and date, and ensure that the preparer signs the form.

- Finally, save the completed form, and consider downloading, printing, or sharing it as needed.

Complete your documents effortlessly online to ensure compliance and clarity in labor agreements.

Related links form

Labor Law Section 191 outlines the frequency by which employees must be paid. Manual Workers: Wages must be paid weekly and not later than seven calendar days after the end of the week in which the wages are earned.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.