Loading

Get St-38 St-387 - Controller - Controller Nd

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the ST-38 ST-387 - Controller - Controller Nd online

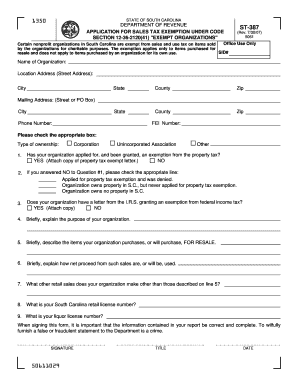

Navigating the ST-38 ST-387 form for sales tax exemption can seem daunting, but this guide is here to simplify the process. By following these detailed steps, you will be able to efficiently complete the form and ensure all necessary information is accurately provided.

Follow the steps to fill out the form correctly.

- Click ‘Get Form’ button to obtain the form and open it in the editor.

- Begin by providing the name of your organization in the designated field. Ensure that the name is spelled correctly, as this is essential for your application.

- Enter the location address of your organization, including street address, city, state, county, and zip code. This information must be precise to prevent any processing delays.

- Fill in the mailing address if it differs from the location address. This should also include street or P.O. Box, city, state, and zip.

- Provide a contact phone number to ensure that the Department of Revenue can reach you if additional information is needed.

- Insert your organization’s FEI number in the corresponding field, which is necessary for tax exemption processing.

- Indicate the type of ownership by checking the appropriate box: Corporation, Unincorporated Association, or Other.

- Answer the questions regarding property tax exemption. If applicable, attach a copy of the property tax exempt letter if your organization has been granted an exemption.

- State if your organization has a letter from the I.R.S. granting an exemption from federal income tax, including necessary attachments.

- In the following fields, briefly explain the purpose of your organization, describe items purchased for resale, and clarify how proceeds from sales will be utilized.

- Detail any other retail sales conducted by your organization, and provide the South Carolina retail license number and liquor license number if applicable.

- Finally, ensure to check the accuracy of all provided information, then sign and date the form as the authorized individual.

- After completing the form, review it one last time before submitting. You will have options to save changes, download the form, print it, or share as needed.

Start filling out your ST-38 ST-387 form online today to secure your sales tax exemption.

There is a long and detailed list of items that are not taxable, but generally, the following are tax exempt: Food for human consumption. Manufacturing machinery. Raw materials for manufacturing. Utilities and fuel used in manufacturing. Medical devices and services.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.