Loading

Get 4 Common Encumbrances On Real Estate You Should Know About ...

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the 4 common encumbrances on real estate you should know about online

Filling out the encumbrance form correctly is essential for real estate transactions. This guide provides clear, step-by-step instructions tailored to users with varying levels of experience, ensuring you can complete the form confidently and accurately online.

Follow the steps to fill out the form with ease

- Click 'Get Form' button to access the encumbrance form and open it in your preferred document editor.

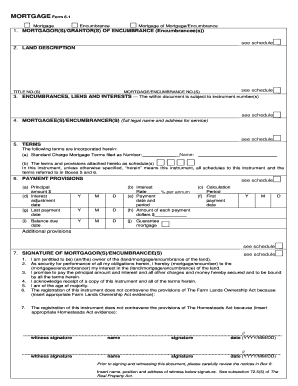

- Begin with section one by entering the names of the mortgagor(s) or grantor(s) of the encumbrance as specified in the schedule. Ensure all names are spelled correctly and formatted as required.

- Proceed to the land description section. Fill in the title number(s) and the mortgage or encumbrance number(s) as found in the schedules. Accuracy is crucial to maintain proper property records.

- In the encumbrances, liens, and interests section, refer to the specified instrument number(s). This helps clarify any existing claims against the property.

- Enter the complete legal name and address for service of the mortgagee(s) or encumbrancer(s) as listed in the schedule. This is vital for future correspondence regarding the mortgage.

- For the terms section, outline any standard charge mortgage terms filed and include the relevant schedule(s). Review this section carefully to ensure all terms are accurately represented.

- Fill out the payment provisions with all necessary details: principal amount, interest rate, payment dates, calculation periods, and last payment dates. Ensure you reference the correct schedule for any additional specifications.

- Once all fields are completed, review the entire form for accuracy. Make any necessary adjustments to ensure every detail is correct and complete.

- After final review, you are ready to sign. Ensure the signatures of all mortgagor(s)/encumbrancee(s) are appended, along with required witness information and dates.

- Finally, save your changes, and choose to download, print, or share the completed form as needed for your records and submission.

Begin filling out your documents online today to ensure a smooth real estate transaction!

Common Types Of Encumbrances. Encumbrances can cover a variety of financial and non-financial claims on a property. The most common types of encumbrances are legal encumbrances, financial encumbrances, easements, restrictive covenants and leases.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.