Loading

Get D 1040nr Form

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the D 1040nr Form online

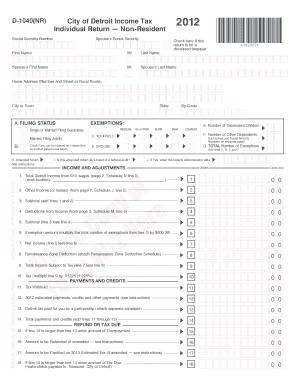

The D 1040nr Form is designed for individuals who are non-residents filing an income tax return for the City of Detroit. This guide will provide clear, step-by-step instructions on how to complete this form online, ensuring you accurately report your income and deductions.

Follow the steps to successfully complete your D 1040nr Form online.

- Click the ‘Get Form’ button to obtain the D 1040nr Form and open it in the editor.

- Begin by entering your Social Security Number and the Social Security Number of your spouse, if applicable. If this return is for a deceased taxpayer, mark the provided checkbox.

- Provide your first and last name, followed by your spouse’s name if you're married. Enter your home address, including city, state, and zip code.

- Select your filing status from the options provided: 'Single or Married Filing Separately' or 'Married Filing Jointly.'

- Indicate if you can be claimed as a dependent on another person's tax return by checking the corresponding box.

- Complete the exemptions section, listing yourself and your spouse, along with the number of dependent children and other dependents.

- Report your total Detroit income from W-2 wages and any other income or losses in the appropriate fields. Note that this includes filling out separate schedules for other types of income.

- Calculate your net income and determine your tax obligations by considering deductions, credits, and any payments made. This will help you identify if you owe taxes or are due a refund.

- Review your entries carefully to ensure accuracy and compliance with instructions, including any necessary attachments such as W-2 forms.

- Finalize by saving your changes, downloading a copy for your records, and choosing to print or share the form as needed.

Complete your D 1040nr Form online today to ensure timely filing and compliance with tax regulations.

IRS Form 1040NR is a variation of Form 1040, which taxpayers use to file their Annual Tax Return. This variation is for individuals who are not American citizens and who do not pass the Substantial Presence Test. IRS Form 1040NR is also known as the U.S. Nonresident Alien Income Tax Return.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.