Loading

Get Form 8879-s - Irs Video Portal - Irsvideos

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to use or fill out the Form 8879-S - IRS Video Portal - Irsvideos online

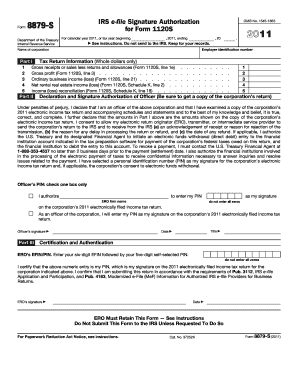

Filling out Form 8879-S is a crucial step for corporate officers authorizing the electronic filing of an S corporation's income tax return. This guide provides clear and supportive instructions on how to complete this form online to ensure your submission is accurate and compliant.

Follow the steps to complete the Form 8879-S effectively.

- Click ‘Get Form’ button to obtain the form, which will open it in your document management system.

- Fill in the top section of the form with the name of the corporation and its employer identification number. Ensure these details match the corporation's official documents.

- In Part I, enter the required tax return information as whole dollars, ensuring you copy the figures directly from Form 1120S. This includes gross receipts, gross profit, ordinary business income or loss, and net rental real estate income or loss.

- Once the ERO receives the signed form, they will finalize electronic submission of the income tax return to the IRS.

- Users may choose to save changes, download, print, or share the completed form as needed for their records.

Take control of your digital document management by completing your documents online efficiently.

For tax preparers authorized to file taxes on their clients' behalf, eSignature conforms with IRS requirements for eSigning Forms 8878 and 8879, IRS e-file Signature Authorization forms.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.