Loading

Get Application For Canadian Old Age, Retirement And Survivors ...

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Application for Canadian Old Age, Retirement and Survivors benefits online

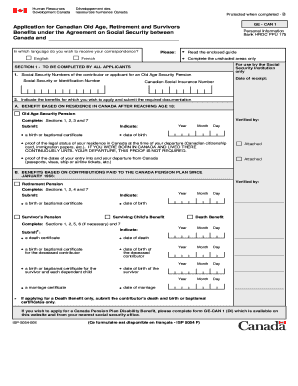

Filling out the Application for Canadian Old Age, Retirement and Survivors benefits can seem daunting. This guide will help you understand each section of the application and provide clear instructions for completing it online.

Follow the steps to successfully complete your application online.

- Click ‘Get Form’ button to obtain the form and open it in the editor.

- Complete Section 1, which requires the applicant’s Social Security or Identification Number and the benefits you wish to apply for. Clearly indicate whether you're applying for an Old Age Security Pension, Retirement Pension, Survivor's Pension, or other benefits and ensure you attach the required documentation.

- Fill out Section 2, which gathers general information about the applicant. This includes personal details such as name, address, and marital status. Make sure to include your relationship to the deceased contributor if applicable.

- If applying for an Old Age Security Pension, complete Section 3, detailing your date and place of entry into Canada and your legal status in Canada at the time of departure.

- In Section 4, provide information specific to your application for a Canada Pension Plan Retirement Pension, including the desired start date of your pension.

- When applying for a Survivor's Pension or a Death Benefit, complete Section 5 with relevant applicant information and your relationship to the deceased contributor.

- If applicable, fill out Section 6 for a surviving child's benefit, including the child's details.

- Finally, review and sign the declaration in Section 7 to validate the information provided. If someone is submitting the application on behalf of the applicant, include their information as required.

- After completing the application, ensure you save any changes. You can then download, print, or share the form as needed.

Complete your application online today to ensure a smooth process!

If a resident of the United States receives Social Security from Canada, it will only be taxable in the United States as if it was being received as U.S. Social Security — except that if it would have been exempt in Canada then it will be exempt from U.S. tax as well.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.