Loading

Get Irs 571c Form

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the IRS 571C form online

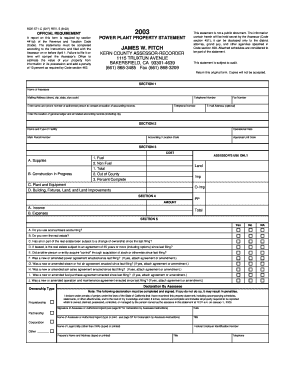

Filling out the IRS 571C form online can seem daunting, but with clear guidance, you can complete it efficiently. This guide provides step-by-step instructions to help you navigate each section of the form, ensuring you provide all required information accurately.

Follow the steps to fill out the IRS 571C form online

- Click the ‘Get Form’ button to obtain the IRS 571C form and open it for editing.

- In Section 1, enter your name as the assessee, complete your mailing address, and provide your telephone number. Also, indicate the name and phone number of the authorized contact person at your accounting records.

- In Section 2, provide details about your facility, including the name, type, operational date, main parcel number, and any relevant codes.

- In Section 3, report the cost of supplies, construction in progress, plant and equipment, and buildings. Ensure that all amounts are reported in whole dollars.

- In Section 4, summarize total income and expenses from Sections 7 and 8, ensuring accuracy.

- In Section 5, answer the yes/no questions regarding various ownership and operational inquiries. This includes indicating if you own real estate or if there have been changes in ownership.

- In Sections 6 to 10, carefully enter data related to systems, income, expenses, and monthly operational information, ensuring that all figures align with your records.

- In Sections 11 to 16, report any production information, fixed plant and equipment updates, and any leased equipment details, as necessary.

- Before finalizing, review all sections for accuracy and completeness. Once satisfied, save your changes, and prepare to download, print, or share the completed form.

Complete your IRS 571C form online today for accurate and timely submission.

If you've lost your notice, call one of the following toll-free numbers for help: Individual taxpayers: 800-829-1040 (TTY/TDD 800-829-4059) Business taxpayers: 800-829-4933.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.