Loading

Get Pennsylvania Claim For Reassessment Exclusion For Transfer Between Parent And Child Form

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Pennsylvania Claim For Reassessment Exclusion For Transfer Between Parent And Child Form online

This guide provides a detailed overview of how to effectively fill out the Pennsylvania Claim For Reassessment Exclusion For Transfer Between Parent And Child Form online. Whether you are a first-time user or have some experience, this step-by-step approach will guide you through each section of the form seamlessly.

Follow the steps to complete your form accurately and efficiently.

- Click the ‘Get Form’ button to obtain the form and open it in your preferred editor.

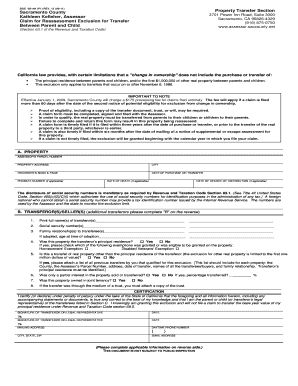

- Locate Section A titled 'Property'. Here, provide essential property information including the Assessor's Parcel Number and the property address.

- Fill in the property owner details. Under 'Transferor(s)/Seller(s),' print the full name(s) of the transferor(s) and their social security number(s). Make sure to include the family relationship(s) to the transferee(s).

- Indicate if the property was the transferor's principal residence by selecting 'Yes' or 'No' and specify any exemptions that apply.

- If applicable, note whether the property transferred was real property other than the principal residence and attach a list of previous transfers.

- Proceed to the Certification section. Read the declaration and sign under penalty of perjury, confirming that all information provided is true.

- Next, navigate to Section C for 'Transferee(s)/Buyer(s)'. Fill in the transferee(s) full names and their relationship to the transferor(s).

- Complete the Certification for the transferee(s) following the same procedure as in the transferor's section and provide any requisite details.

- Review all completed sections for accuracy, ensuring every required field is filled.

- Once double-checked, you may save your changes, download the completed form, print it, or share it as necessary.

Complete your Pennsylvania Claim for Reassessment Exclusion For Transfer Between Parent And Child Form online today!

Proposition 58, effective November 6, 1986, is a constitutional amendment approved by the voters of California which excludes from reassessment transfers of real property between parents and children. Proposition 58 is codified by section 63.1 of the Revenue and Taxation Code.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.