Loading

Get Decline-in-market Value Request For Assessor Review (prop 8) - Assessor Saccounty

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Decline-in-Market Value Request For Assessor Review (Prop 8) - Assessor Saccounty online

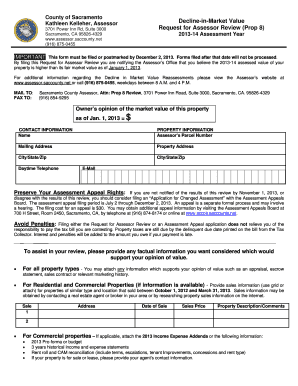

This guide provides a clear and supportive approach to filling out the Decline-in-Market Value Request for Assessor Review form, commonly referred to as Prop 8, for the Sacramento County Assessor’s Office. Follow these steps to ensure your request is submitted accurately and timeliness.

Follow the steps to complete your request online.

- Press the ‘Get Form’ button to access the form and open it in your preferred editing tool.

- Begin by entering the owner’s opinion of the market value of the property as of January 1, 2013, in the designated field.

- Fill out the contact information section, including your name, daytime telephone number, and email address to facilitate communication.

- Provide the property information, including the assessor’s parcel number, mailing address, property address, and city/state/zip for both mailing and property locations.

- In the provided space, offer any factual information that supports your opinion of value. You may attach relevant documents such as an appraisal or recent sales data.

- If applicable, fill in details about similar properties that sold between October 1, 2012, and March 31, 2013, using the grid format provided for ease of comparison.

- If you are submitting information for commercial properties, ensure to attach the necessary financial documents, including income expense statements and a rent roll.

- Once all fields are completed, review your inputs for accuracy. Save changes, and use available options to download, print, or share the form for submission.

Take action today by filling out your Decline-in-Market Value Request online.

If you own a home and occupy it as your principal place of residence, you may apply for a Homeowners' Exemption. This exemption will reduce your annual assessed value by $7,000. Exemption becomes ineligible for the exemption. Homeowners' Exemptions are not automatically transferred between properties.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.