Loading

Get Form 15ca Pdf

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Form 15ca Pdf online

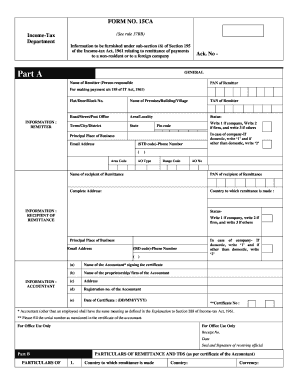

Form 15ca is a crucial document required for remittances to non-residents or foreign companies as per the Income-tax Act, 1961. This guide will provide a comprehensive walkthrough on how to complete and submit the form online, ensuring you accurately fulfill all requirements.

Follow the steps to fill out Form 15ca accurately.

- Click the ‘Get Form’ button to obtain the form and open it in your preferred PDF editor.

- Start by entering the General Information in Part A. Fill in the name of the remitter, their PAN, and other basic details like address, TAN, and the status of the remitter (company, firm, or others). Ensure that you accurately select ‘1’, ‘2’, or ‘3’ based on your entity type.

- Complete the recipient of the remittance section. Provide the name and PAN of the recipient, along with their complete address and status. You must also indicate the principal place of business and contact details.

- In the accountant’s information section, provide the name, registration number, and address of the accountant certifying the form. Ensure the date of the certificate is entered correctly.

- Proceed to Part B for particulars of the remittance. This section includes details such as the country of remittance, amount in foreign currency, TDS details, and the nature of remittance. Fill out each field thoroughly and accurately.

- Indicate whether tax has been deducted at source. If the remittance corresponds to royalties or other specific categories, provide additional details and check the appropriate boxes regarding tax applicability.

- Complete the verification section at the bottom of the form, declaring that the information provided is true to the best of your knowledge. Make sure to include your full name, sign, and date the document.

- Finally, review the completed form for accuracy. Once everything is filled out correctly, you can save changes, download, print, or share the form as needed.

Complete your Form 15ca online today to ensure compliance with tax regulations.

Step 1: Log in to the e-Filing portal with valid CA credentials. Step 2: On your Dashboard, click Worklist > Pending Actions. Step 3: On the File Income Tax Forms page, select Form 15CB. Alternatively, enter Form 15CB in the search box to file the form.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.