Loading

Get Stanislaus County Boe 267 First Filing Form

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Stanislaus County Boe 267 First Filing Form online

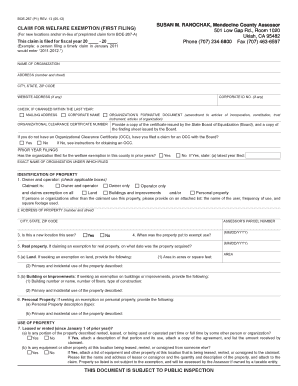

Completing the Stanislaus County Boe 267 First Filing Form online is an essential process for organizations seeking a welfare exemption from property taxes. This guide provides a clear, step-by-step approach to help users navigate each section of the form with ease.

Follow the steps to successfully complete the form online.

- Press the ‘Get Form’ button to obtain the form and open it in your preferred editor.

- Enter the fiscal year for which you are filing the claim in the designated field (e.g., 20____ - 20____). Use the format provided, ensuring that it accurately reflects the year of the claim.

- Fill in the name of the organization, including the address, city, state, zip code, and website address, if applicable. Ensure that all details are accurate to avoid delays in processing your claim.

- If there has been a change in the mailing address within the last year, check the appropriate box and provide the new mailing address.

- If applicable, provide the corporate ID number and organizational clearance certificate number. Indicate whether you have filed a claim for an Organizational Clearance Certificate with the State Board of Equalization.

- Indicate whether the organization has filed for the welfare exemption in this county in prior years. If yes, provide the latest year filed and the exact name of the organization used for that filing.

- Identify the ownership and operation of the property by checking the appropriate boxes. Provide clarity on whether the claim is for ownership and operation or ownership only.

- Fill in the address of the property for which the exemption is claimed, along with the Assessor’s Parcel Number. Confirm whether this is a new location this year.

- For real property, input the acquisition date. Detail the area in acres or square feet and describe the primary and incidental uses of the property. If applicable, detail specifics for buildings or improvements.

- Answer questions regarding leasing, living quarters, and any unrelated business taxable income. Attach any necessary documentation to support your claims.

- Provide the contact information for someone who can be reached during business hours for additional inquiries. Include their name, title, telephone number, and email address.

- Finally, certify the claim by signing and dating the form. Ensure that the certification is completed by the correct individual authorized to represent the organization.

- Once the form is fully completed, you can save your changes, download, print, or share the document as required.

Take action now to complete your Stanislaus County Boe 267 First Filing Form online and ensure your application is submitted on time.

Starting on April 21, 2021, Prop 19 expands the group of homeowners who qualify for a transfer of their taxable value from their current home to a new property.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.