Loading

Get It 10b

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the IT-10B online

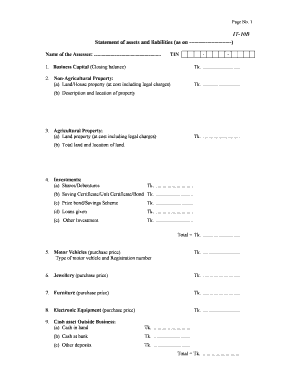

The IT-10B is a statement of assets and liabilities that users need to complete accurately for financial assessments. This guide will walk you through each section of the form with clear instructions to ensure you fill it out correctly online.

Follow the steps to complete the IT-10B form online

- Click the ‘Get Form’ button to obtain the form and open it in the editor.

- In the first field, enter the name of the assessee, which refers to the individual completing the form.

- Next, provide the Taxpayer Identification Number (TIN) in the designated format.

- For the business capital, input the closing balance in the specified currency field.

- In the non-agricultural property section, list the land or house property at cost, including legal charges, and provide a description and location of the property.

- For agricultural property, detail the land property cost, including legal charges, and specify the total land along with its location.

- Under investments, enter the amounts for various types of investments, including shares, savings certificates, loans given, etc., and calculate the total.

- Detail the motor vehicles owned, including the type and registration number, and input the purchase prices.

- List the purchase prices of jewellery, furniture, and electronic equipment in the appropriate fields.

- In the cash assets section, specify cash in hand, cash at bank, and other deposits, and total these amounts.

- Input details for other assets if applicable and calculate total assets.

- Next, in the liabilities section, list mortgages, unsecured loans, bank loans, and others, and calculate the total liabilities.

- Calculate and input the net worth by deducting total liabilities from total assets.

- Finally, provide information regarding family and special expenditures, and indicate the number of dependent children.

- At the end of the form, affirm your declaration by signing and dating it.

Complete your IT-10B online to ensure accurate financial reporting.

Further, the existing Form 10B can continue to apply to smaller public charitable trusts having gross income below Rs. 2 crores. 2. Given the fact that the audit of quite a few trusts for financial year 2018-19 has already been completed, the amended Form 10B should be made applicable from AY 2020-21 onwards.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.