Loading

Get Pit Form

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Pit Form online

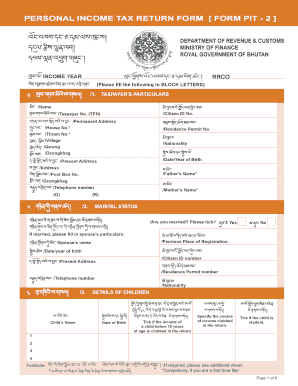

Filling out the Pit Form online can streamline your personal income tax return process. This guide provides clear and supportive instructions to help you navigate each section of the form effortlessly.

Follow the steps to complete your Pit Form successfully.

- Press the 'Get Form' button to access the Pit Form and open it in your online document editor.

- Begin by entering your taxpayer's particulars in block letters. This section requires information such as your name, citizen ID number, taxpayer number, permanent address, and other personal details.

- Indicate your marital status by ticking the appropriate box. If you are married, fill in your spouse's particulars, including their name, date of birth, and contact information.

- If you have children, list their names and dates of birth. Additionally, indicate if any child's income is being clubbed in your return and specify the source.

- Complete the income computation worksheet by detailing gross income from salary, consultancy services, rental property, dividends, interest, cash crops, and any other sources.

- Calculate your total adjusted gross income by transferring amounts from each section of the income computation worksheet to the total table provided.

- Deduct any applicable general deductions from your total adjusted gross income to determine your net taxable income.

- Calculate your self-assessed tax based on the net taxable income, using the income slabs provided.

- In the final steps, provide details of any taxes already prepaid or deducted at source and calculate the final tax payable or refundable.

- Review all entries for accuracy. Ensure that your signature, bank account number (if applicable), and any necessary authorizations are included. Save changes, then download, print, or share your completed Pit Form.

Visit your online platform to complete your Pit Form and ensure timely submission.

Wages are subject to all employment (payroll) taxes and reportable as Personal Income Tax (PIT) wages unless otherwise stated. Wages paid to employees are taxable, regardless of the method of payment, whether by private agreement, consent, or mandate.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.