Loading

Get C-8000, 2006 Single Business Tax Annual Return - State Of Michigan - Mi

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the C-8000, 2006 Single Business Tax Annual Return - State Of Michigan - Mi online

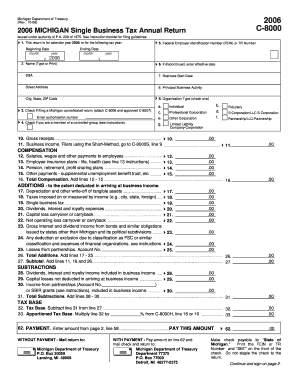

The C-8000 form is required for businesses conducting activities in Michigan with gross receipts of $350,000 or more. This guide will provide straightforward, step-by-step instructions for filling out the form online, ensuring adherence to filing requirements.

Follow the steps to complete your C-8000 form efficiently.

- Press the ‘Get Form’ button to access the C-8000 form and open it in the online editor.

- Enter the taxable year in line 1, specifying the beginning and ending dates (month and year) for your accounting period. Ensure that it aligns with your IRS reporting period.

- Complete line 2 by typing or printing your business name, including any doing-business-as (DBA) name.

- If applicable, select line 3 to indicate if you are filing a Michigan consolidated return. Provide the authorization number as needed and attach Form C-8008.

- On line 4, check the box if you are a member of a controlled group. Familiarize yourself with the requirements detailed in the instructions.

- On line 5, provide your Federal Employer Identification Number (FEIN) or Michigan Treasury (TR) Number. Individuals without an account number should enter their Social Security number.

- Fill out the business start date in line 7 to indicate when your business began operations in Michigan.

- In line 8, describe your principal business activity briefly, using relevant categories like manufacturing or retail trade.

- Select the organization type in line 9 that best describes your business entity (e.g., partnership, corporation).

- Calculate and enter your gross receipts in line 10. Use the Gross Receipts Checklist provided in the instructions for accuracy.

- In line 11, report your business income based on your calculation from the provided worksheets.

- Proceed by completing the remaining lines as instructed, ensuring that all entries reflect your financial details accurately.

- Once finished, review your form for completeness, make any necessary adjustments, and proceed to save changes, download, print, or share the C-8000 form accordingly.

Complete your C-8000 form online today to stay compliant with your business tax obligations.

All taxpayers other than financial institutions and insurance companies (described here as standard taxpayers) with nexus and apportioned or allocated gross receipts equal to $350,000 or more and whose CIT tax liability is greater than $100 must file a CIT Annual Return (Form 4891).

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.