Loading

Get Life Insurance Disclosure Form

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Life Insurance Disclosure Form online

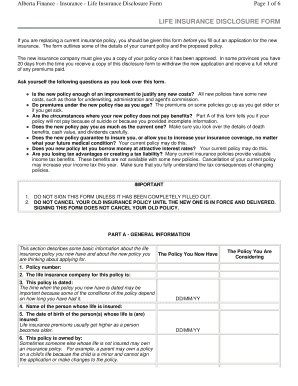

Filling out the Life Insurance Disclosure Form online can seem daunting, but this guide provides you with straightforward instructions to help you navigate each section with ease. This form is crucial for individuals considering replacing an insurance policy, as it outlines key details about your current and proposed coverage.

Follow the steps to complete the form accurately.

- Click ‘Get Form’ button to obtain the Life Insurance Disclosure Form and open it online.

- In Part A, input general information about your current policy. Start with your policy number, the name of your insurance company, the date the policy was issued, and details about the insured person, including their name and date of birth.

- Continue in Part A by providing information about the proposed policy you are considering, including its name and checking off any relevant health changes or risky activities that may affect your premiums.

- In Part B, specify the premiums for both your current and proposed policies, indicating whether they will stay the same, increase, decrease, or fluctuate.

- Proceed to Part C to disclose the death benefits associated with each policy, including the basic death benefit and any additional guaranteed benefits.

- Move to Part D to address the guaranteed cash values of both policies, indicating if there is a cash value and what that amount would be if the policy were canceled.

- In Part E, specify if the policies are Universal Life or Variable Life policies and mention the minimum and maximum premiums along with the guaranteed interest rates.

- Use Part F to explain your reasons for replacing your current policy and how the new policy better meets your needs.

- Where applicable, complete any commentary needed in Part G and provide future projections in Part H.

- Finally, read and confirm both the consumer's and agent's statements in Part I. Ensure that all fields are completely filled out before signing.

- After completing the form online, save your changes and consider downloading or printing a copy for your records.

Take action today by filling out the Life Insurance Disclosure Form online to ensure your coverage meets your needs.

The purpose of a disclosure statement is to provide explanatory information regarding the significant features of the insurance policy to enable the insured to make an informed decision regarding purchasing the insurance policy.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.